Buying a new car is a major financial decision, and it’s easy to get overwhelmed by all the options and considerations. While the excitement of owning a new vehicle is undeniable, it’s important to be aware of potential problems that could arise during the car purchasing process. These problems can range from minor inconveniences to significant financial burdens, so being informed can help you navigate the process smoothly and avoid any unpleasant surprises.

This comprehensive guide will delve into common New Car Purchasing Problems, providing insights and advice on how to avoid or address them. We’ll explore the various stages of the car buying journey, from initial research to financing and post-purchase considerations, offering practical solutions and actionable steps.

Understanding Common New Car Purchasing Problems

Many factors can contribute to problems during the car buying process. These problems can arise from:

- The Manufacturer: Defective parts, design flaws, or production errors can lead to issues with the vehicle’s performance, safety, or reliability.

- The Dealership: Aggressive sales tactics, misrepresentation of vehicle features, or inadequate customer service can create a negative buying experience.

- The Finance Company: High interest rates, hidden fees, or difficulties securing financing can add to the overall cost of ownership.

- The Buyer: Lack of research, poor decision-making, or failure to negotiate a fair price can result in buyer’s remorse.

The Initial Research Stage: Where Problems Can Begin

The initial research phase of the car buying process is crucial. It’s where you lay the groundwork for a successful purchase by:

- Identifying Your Needs: Clearly define your requirements, including budget, vehicle type, features, and intended use.

- Researching Car Models: Explore different models, compare specifications, and read reviews to understand their strengths and weaknesses.

- Understanding Market Values: Research current market prices to ensure you’re getting a fair deal. This can be done using online tools, checking local dealerships, and comparing prices across different states.

What Can Go Wrong During Research?

- Overlooking Important Features: Failing to thoroughly research and compare features can lead to purchasing a vehicle that doesn’t meet your needs.

- Relying Solely on Reviews: While reviews can offer valuable insights, they should be taken with a grain of salt. Focus on unbiased sources and consider the overall picture.

- Falling Prey to Marketing Gimmicks: Be cautious of marketing tactics that emphasize superficial features or promote unrealistic promises.

- Ignoring Potential Issues: Don’t dismiss warning signs or negative feedback about a specific car model.

Navigating the Dealership: Common Pitfalls to Avoid

Once you’ve narrowed down your choices, it’s time to visit dealerships. While dealerships are the gateway to your dream car, be aware of potential problems that can arise:

- Pressure Tactics: Some salespeople employ aggressive tactics to push you into a quick purchase. Stay calm, firm, and don’t be afraid to walk away if you feel pressured.

- Hidden Fees: Dealerships may add hidden fees to the purchase price, such as documentation fees, dealer prep charges, or administration charges. Be sure to review all fees before signing any agreements.

- Misrepresentation of Information: Dealerships might misrepresent vehicle features or conditions. Carefully inspect the car and ensure it aligns with your expectations.

- Unsatisfactory Customer Service: Poor customer service can turn a pleasant buying experience into a frustrating one. Choose dealerships with a reputation for good customer service.

Expert Tip: “Always research the dealership’s reputation before visiting. Online reviews, customer testimonials, and Better Business Bureau ratings can provide valuable insights,” says John Davis, a seasoned automotive expert.

Securing Financing: Understanding the Potential Complications

Financing is a crucial aspect of purchasing a new car. Obtaining the best loan terms can make a significant difference in your overall cost of ownership.

- High Interest Rates: High interest rates can add thousands of dollars to your overall loan cost. Research different lenders and compare interest rates to secure the best offer.

- Hidden Fees: Banks and finance companies might charge hidden fees, such as origination fees, processing fees, or early payment penalties. Read the fine print carefully and negotiate any unnecessary fees.

- Credit Score Issues: Your credit score plays a significant role in determining loan terms. If you have a low credit score, you may face higher interest rates. Improving your credit score before applying for a loan can help you secure better terms.

- Loan Term Length: A longer loan term may result in lower monthly payments but can lead to paying significantly more interest over the life of the loan. Choose a loan term that balances affordability with overall cost.

Expert Tip: “Don’t hesitate to shop around for the best financing options. You might be surprised at the difference in interest rates and terms offered by different lenders,” says Susan Miller, an experienced financial advisor.

Post-Purchase Considerations: Ensuring Smooth Ownership

Even after you’ve signed the paperwork, there are important considerations to ensure a smooth ownership experience:

- Vehicle Delivery: Ensure the vehicle is delivered in pristine condition and meets your expectations.

- Warranty and Maintenance: Understand the terms of your warranty, including coverage, duration, and limitations. Schedule regular maintenance appointments as recommended.

- Insurance: Obtain adequate car insurance coverage to protect yourself financially in case of an accident or damage.

- Registration and Licensing: Complete the required paperwork and obtain license plates for your new vehicle.

Conclusion

Buying a new car can be both exciting and daunting. By understanding common problems that can arise during the process, you can minimize potential risks and ensure a smoother buying experience. Remember to conduct thorough research, choose dealerships with good reputations, negotiate carefully, and secure financing with favorable terms.

At Autotippro, we understand the complexities of car purchasing. Our team of automotive experts is committed to providing you with the knowledge and support you need to make informed decisions. If you have any questions or concerns about new car purchasing problems, please don’t hesitate to contact us at +1 (641) 206-8880.

AutoTipPro

500 N St Mary’s St, San Antonio, TX 78205, United States

FAQ

Q: What should I do if I experience a problem with my new car?

A: Contact the dealership or manufacturer immediately. Document the issue and provide evidence, such as photos or videos.

Q: How can I negotiate a better price on a new car?

A: Research market values, use online tools for price comparisons, and be prepared to walk away if you don’t feel comfortable with the deal.

Q: What is the best way to finance a new car?

A: Compare interest rates and terms from different lenders, including banks, credit unions, and online lenders. Choose a loan term that aligns with your financial goals.

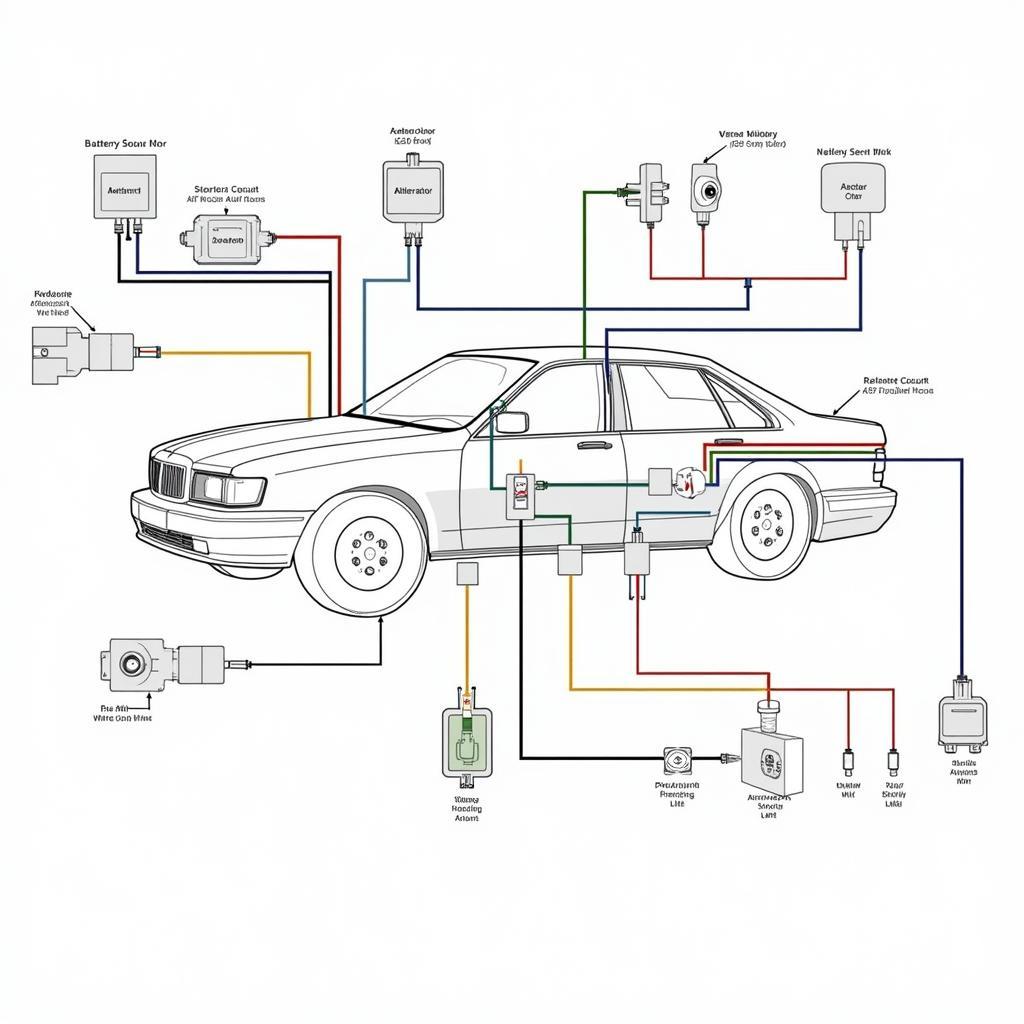

Q: What are the most common types of new car problems?

A: Some common issues include electrical problems, engine malfunctions, transmission issues, and faulty brakes.

Q: What can I do to prevent new car problems?

A: Conduct thorough research, inspect the vehicle carefully, and obtain a pre-purchase inspection from a trusted mechanic.

Leave a Reply