Understanding the complexities of taxes and maintenance for car rentals can be crucial for both car owners renting out their vehicles and those running car rental businesses. Properly managing these aspects can significantly impact profitability and customer satisfaction.

Similar to regular car ownership, maintaining a rental car involves regular checks and upkeep. Learn more about general car maintenance at lyft rental car maintenance.

Navigating Taxes on Car Rental Income

Taxes related to car rentals can seem daunting, but with a clear understanding of the regulations, you can ensure compliance and optimize your tax strategy. Rental income is generally considered taxable income, subject to federal and potentially state and local taxes. The specific tax implications vary based on factors such as the rental duration, personal versus business use of the vehicle, and your overall tax bracket. For vehicles used primarily for rental purposes, you can deduct expenses related to the rental activity, including maintenance, insurance, and depreciation.

Understanding Deductible Expenses for Car Rentals

Accurately tracking and documenting deductible expenses is vital for minimizing your tax liability. These expenses can include routine maintenance like oil changes and tire rotations, as well as more significant repairs. Keep detailed records of all expenses, including invoices, receipts, and mileage logs, to substantiate your deductions during tax season. Proper documentation is key to a smooth tax filing process and avoiding potential audits.

Maintaining Your Rental Car Fleet for Optimal Performance

Regular maintenance is essential for keeping your rental cars in top condition and ensuring a positive customer experience. A well-maintained vehicle is less likely to experience breakdowns, which can lead to costly repairs and dissatisfied customers. Preventive maintenance, such as regular oil changes, tire rotations, and brake inspections, can help identify potential problems before they become major issues.

Creating a Preventative Maintenance Schedule

Establishing a consistent preventative maintenance schedule is crucial for managing a rental car fleet effectively. This schedule should outline the frequency of various maintenance tasks based on mileage or time intervals. A well-defined schedule helps ensure that all vehicles receive the necessary maintenance, minimizing downtime and maximizing the lifespan of your fleet.

What are the key components of a car maintenance schedule? Regular oil changes, tire rotations, brake inspections, and fluid top-offs are crucial for preventing major issues.

Addressing Common Car Rental Maintenance Issues

Rental cars are subject to more wear and tear than personally owned vehicles. Common issues include tire damage, brake wear, and interior stains. Having a reliable mechanic or repair shop that specializes in car rental maintenance can be invaluable. Promptly addressing these issues not only ensures the safety and reliability of your vehicles but also contributes to positive customer reviews and repeat business.

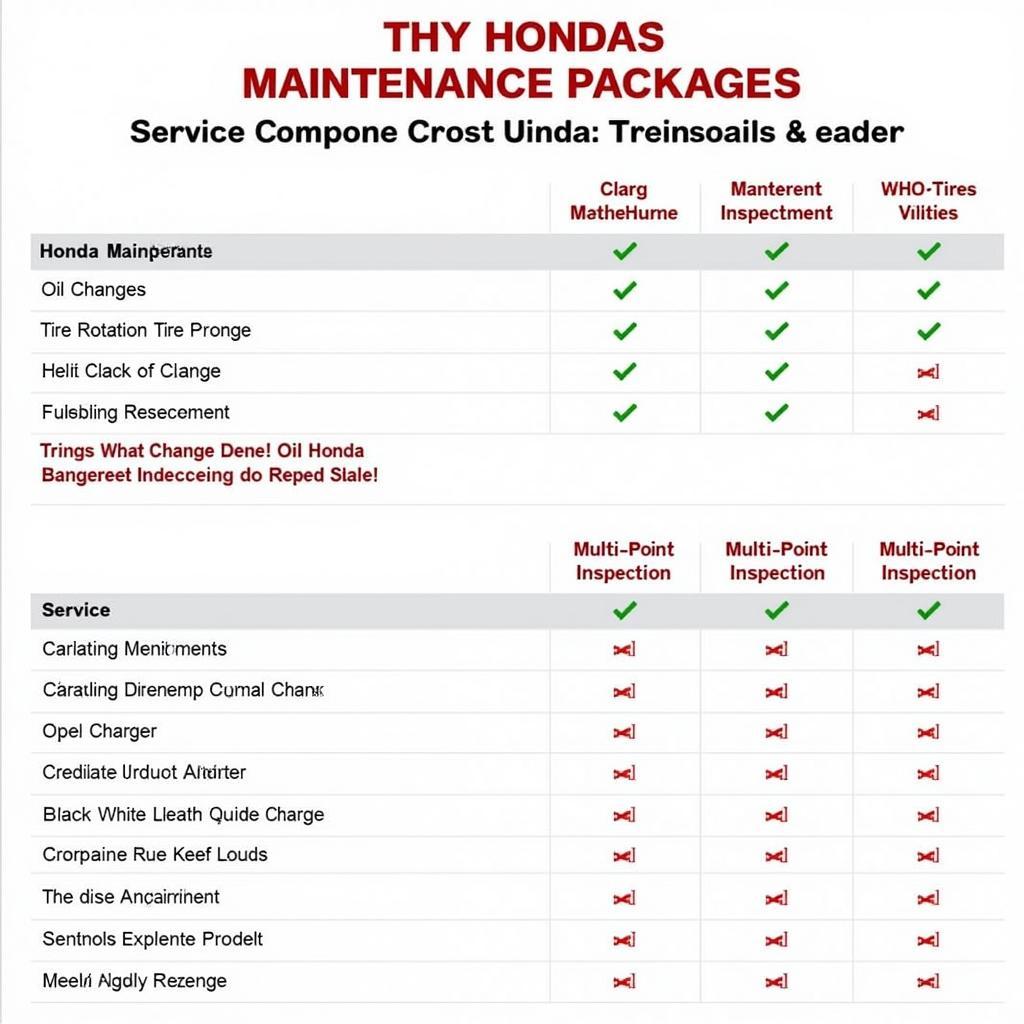

Balancing Cost and Quality in Car Rental Maintenance

Maintaining a rental fleet involves balancing cost considerations with the need for quality repairs and service. While it’s important to keep maintenance costs under control, opting for the cheapest option isn’t always the best strategy. Investing in quality parts and reputable repair shops can save you money in the long run by preventing recurring problems and extending the life of your vehicles.

How can I balance cost and quality? Research reputable repair shops, compare prices for parts and services, and consider the long-term benefits of preventative maintenance.

Expert Insights on Car Rental Taxes and Maintenance

John Davis, a seasoned automotive consultant, emphasizes, “Proper record-keeping is paramount for navigating car rental taxes. Meticulous documentation not only simplifies tax filing but also protects you in case of an audit.” He also adds, “Don’t underestimate the value of preventative maintenance. A small investment upfront can save you thousands in costly repairs down the line.”

Preventative Car Maintenance Checklist for Rentals

Preventative Car Maintenance Checklist for Rentals

Conclusion

Effectively managing taxes and maintenance for car rentals is crucial for success in the car rental industry. By understanding the tax implications, implementing a robust maintenance schedule, and prioritizing both cost-effectiveness and quality, you can maximize profitability and ensure customer satisfaction. We encourage you to connect with us for further assistance. You can reach AutoTipPro at +1 (641) 206-8880 or visit our office at 500 N St Mary’s St, San Antonio, TX 78205, United States.

Remember, meticulous record-keeping and a proactive approach to maintenance are key to a thriving car rental business.

Leave a Reply