Youi Car Insurance Problems can be frustrating, especially when you need them most. This guide will provide you with practical advice, troubleshooting tips, and potential solutions to common issues encountered with Youi car insurance. We’ll explore everything from policy misunderstandings to claims disputes and offer insights to help navigate the process.

Understanding Common Youi Car Insurance Problems

Youi, like any other insurance company, can sometimes face customer dissatisfaction. These problems can range from simple misunderstandings to more complex claims disputes. Some of the most frequently reported Youi car insurance problems include policy coverage confusion, difficulty reaching customer service, delays in claims processing, and disputes over claim valuations.

Policy Coverage Confusion: Decoding Your Policy

One of the most common Youi car insurance problems revolves around understanding the specifics of your policy coverage. This can lead to unexpected out-of-pocket expenses if you’re involved in an accident. Carefully reviewing your policy documents, paying attention to the fine print, and contacting Youi directly for clarification are crucial steps to avoid this.

- What’s covered? Your policy document outlines what’s covered, including accident types, repair costs, and liability limits.

- What’s not covered? Pay close attention to exclusions, such as specific types of damage or situations where coverage may be limited.

- Deductibles and premiums: Understand your deductible (the amount you pay before insurance kicks in) and your premium (your regular payment for coverage).

Difficulty Reaching Customer Service: Getting the Help You Need

Sometimes, simply getting in touch with Youi customer service can be a challenge. Long wait times and difficulty navigating automated systems can be frustrating, especially when you need immediate assistance. Utilizing different communication channels, such as email or online chat, can sometimes be more effective.

Claims Processing Delays: Navigating the Waiting Game

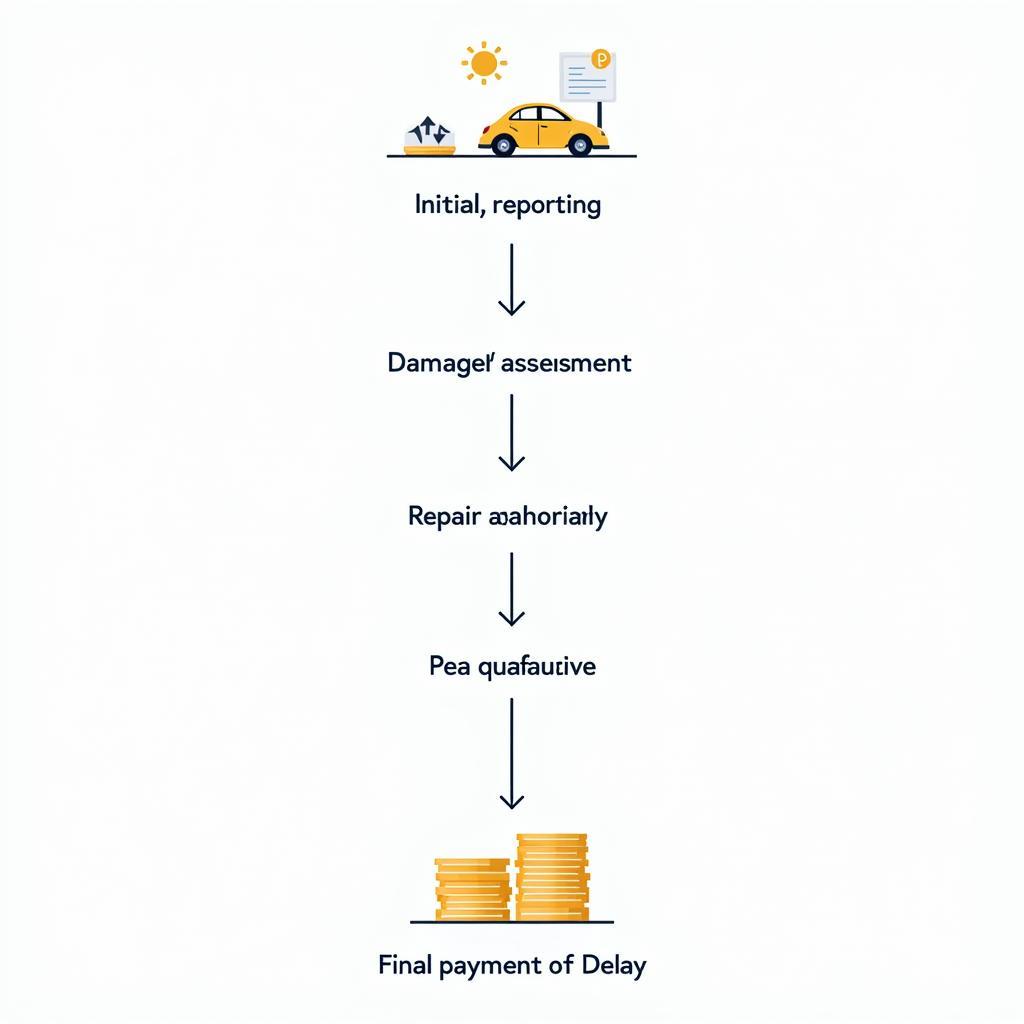

Delays in claims processing are another common complaint. While some delays are unavoidable due to the nature of investigations, excessive delays can be problematic. Staying proactive by regularly following up with Youi and keeping meticulous records of all communication can help expedite the process.  Youi Car Insurance Claims Process Flowchart

Youi Car Insurance Claims Process Flowchart

Resolving Your Youi Car Insurance Problems

Now that we’ve identified some common issues, let’s explore potential solutions and how to effectively navigate the process of resolving your Youi car insurance problems.

Escalating Your Concerns: Reaching the Right People

If your initial attempts to resolve an issue with Youi haven’t been successful, escalating your concern to a higher level within the company can be effective. This might involve contacting a supervisor or filing a formal complaint.

- Document Everything: Keep a detailed record of all communication, including dates, times, names of representatives, and the specifics of your conversations.

- Be Polite but Firm: Maintain a professional and respectful tone while clearly articulating your concerns and desired resolution.

- Know Your Rights: Familiarize yourself with your rights as a policyholder and the relevant consumer protection laws in your region.

Seeking External Assistance: Utilizing Third-Party Resources

If internal escalation fails, seeking external assistance can be your next step. This could involve contacting an independent insurance ombudsman or seeking legal advice from a consumer protection attorney.

Preventing Future Problems: Proactive Measures

The best way to deal with Youi car insurance problems is to try to prevent them in the first place. This involves thoroughly understanding your policy, maintaining open communication with Youi, and staying organized with your insurance documentation.

- Review Your Policy Regularly: Don’t wait until you have a problem to understand your coverage. Regularly review your policy to ensure it still meets your needs.

- Keep Your Information Updated: Notify Youi of any changes to your vehicle, address, or driving habits to ensure accurate premiums and coverage.

- Build a Relationship with Your Agent: Establishing a good relationship with your Youi agent can make communication easier and potentially prevent future issues.

“Proactive communication and a thorough understanding of your policy are key to avoiding insurance headaches,” says John Davies, a seasoned automotive insurance specialist with over 20 years of experience. He emphasizes that “taking the time to review your policy and ask questions can save you a lot of trouble down the road.”

Conclusion

Youi car insurance problems, while frustrating, can often be resolved with proactive communication and a clear understanding of your policy. By utilizing the strategies outlined in this guide, you can navigate the process more effectively and achieve a satisfactory resolution. Remember to keep detailed records, be persistent in your efforts, and don’t hesitate to seek external assistance when necessary. For personalized support and expert advice, connect with us at AutoTipPro at +1 (641) 206-8880 or visit our office at 500 N St Mary’s St, San Antonio, TX 78205, United States. We’re here to help you navigate your Youi car insurance problems and find the best solutions for your situation.

Leave a Reply