Fixing your car before making an insurance claim can be a smart move in certain situations. This guide provides expert advice on how to navigate the process, weigh your options, and make informed decisions about your car repairs.

Should you fix your car before filing an insurance claim? This is a question many car owners ask themselves after an accident or when discovering damage. There are various factors to consider, including the extent of the damage, your deductible, and the potential impact on your insurance premiums. This article explores the complexities of fixing your car pre-insurance claim, offering insights into the advantages and disadvantages, along with practical steps to take. You might want to know can i get my car fixed before insurance claim? Let’s dive in.

Evaluating the Damage and Your Options

The first step after noticing damage to your vehicle is to thoroughly assess the extent of the problem. Is it a minor scratch, a significant dent, or something more serious involving mechanical components? The severity of the damage will significantly influence your decision-making process.

Minor Damage: DIY or Professional Repair?

For minor cosmetic damage like scratches or small dents, a DIY approach might be feasible and cost-effective. Numerous repair kits are available on the market for how to fix crack windows for cars. However, for more extensive damage or if you lack experience with car repairs, seeking a professional is highly recommended.

Significant Damage: Insurance Claim or Out-of-Pocket Repair?

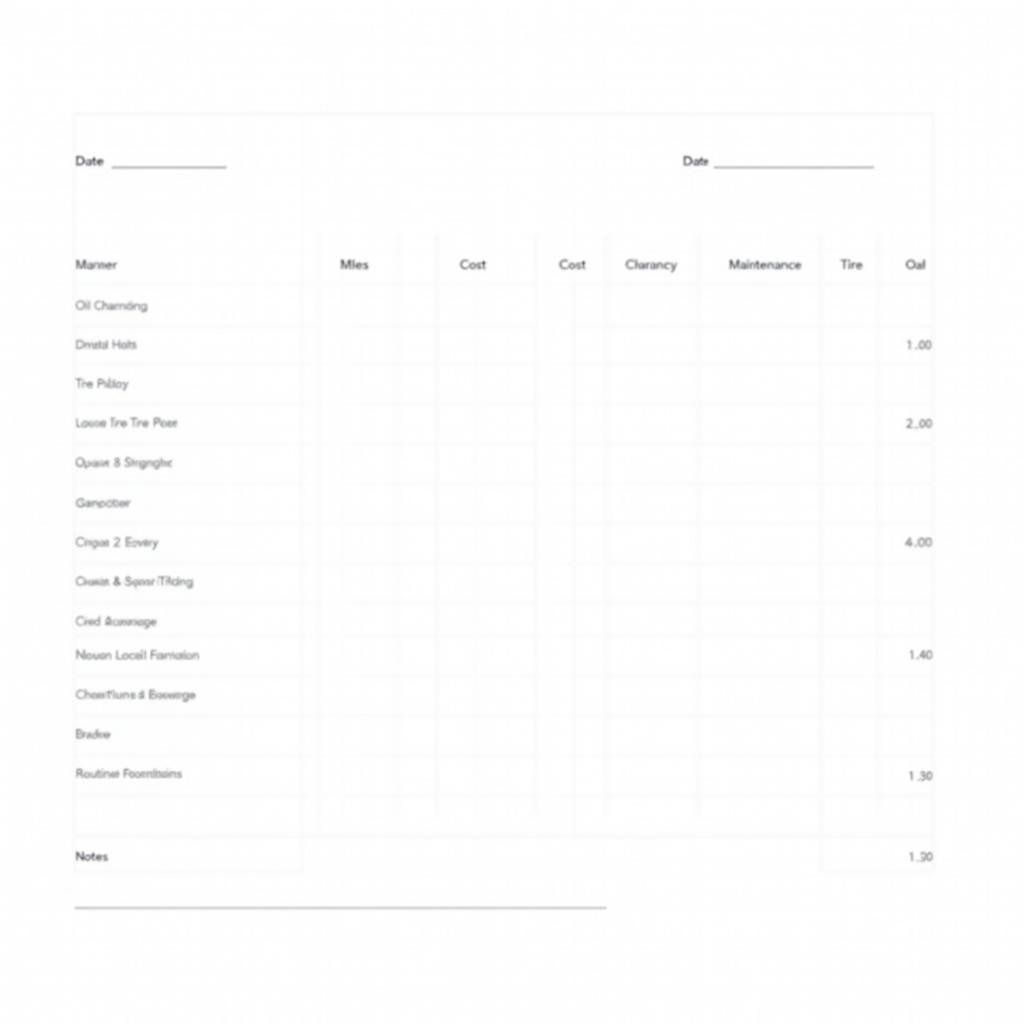

When the damage is significant, the decision becomes more complex. If the repair costs are lower than your insurance deductible, it may be more economical to pay out-of-pocket. However, if the cost exceeds your deductible, filing an insurance claim might be the better option. Always obtain multiple repair estimates from reputable auto repair shops. This will give you a clear picture of the potential expenses and allow you to compare prices. It’s also important to understand your insurance policy’s terms and conditions regarding repairs.

Understanding Your Insurance Policy and Deductible

Before making any decisions about fixing your car before insurance, carefully review your insurance policy. Understand your coverage, deductible, and the potential impact of a claim on your premiums. Some policies might have specific clauses related to pre-claim repairs.

How Your Deductible Affects Your Decision

Your deductible is the amount you are responsible for paying before your insurance coverage kicks in. If the repair cost is lower than your deductible, filing a claim might not be financially beneficial, as you’ll end up paying the full repair cost anyway. In such cases, paying for the repairs yourself is often more sensible. Check out the cost to fix dent on car door.

Impact on Insurance Premiums

Filing an insurance claim, even if the repairs are minor, can potentially lead to an increase in your premiums. Insurance companies view claims as an indicator of increased risk, and this can affect your future insurance costs. Weigh the long-term implications of a premium increase against the immediate cost of the repairs.

Seeking Professional Advice

Consulting with a qualified mechanic and your insurance agent is essential when deciding whether to fix your car before insurance. A mechanic can provide an accurate assessment of the damage and estimated repair costs. Your insurance agent can explain your policy coverage and the potential consequences of filing a claim.

“Getting expert advice is crucial,” says John Smith, a certified automotive technician with over 20 years of experience. “Understanding the full scope of the damage and your insurance coverage will help you make an informed decision that protects your best interests.” Don’t hesitate to ask questions and seek clarification on any aspect of the repair process or your insurance policy.

When to Consider Fixing Before Claiming

Fixing your car before filing an insurance claim might be a viable option if the damage is minor, the repair cost is below your deductible, or you want to avoid a potential premium increase. However, always consult with your insurance company before proceeding with any repairs. Some insurance companies require an inspection of the damage before approving a claim. It’s also important to remember that certain repairs, especially if not done correctly, could impact the structural integrity and safety of your vehicle.

Conclusion

Fixing your car before insurance involves careful consideration of several factors. Assessing the damage, understanding your insurance policy, and seeking professional advice are essential steps in the process. Weighing the costs of repair against your deductible and the potential impact on your premiums will help you make the most informed decision. Contact AutoTipPro at +1 (641) 206-8880 or visit our office at 500 N St Mary’s St, San Antonio, TX 78205, United States for further assistance.

“Remember, transparency is key,” advises Maria Garcia, an insurance claims adjuster with extensive experience in the auto industry. “Communicate with your insurance company throughout the process to avoid any misunderstandings or complications.”

Wondering if you can you get a totaled car fixed? The answer depends on various factors and may require expert advice. Choosing the right approach can save you money and protect your investment in the long run. You may also want to understand more about a fix it tcket before car was repoed.

Leave a Reply