Using insurance to fix your car after an accident or damage can seem daunting. This guide will walk you through the process, from filing a claim to getting your car back on the road. We’ll cover everything you need to know about using your insurance policy for car repairs, including how to navigate the complexities and ensure you get the best possible outcome.

Understanding Your Car Insurance Policy

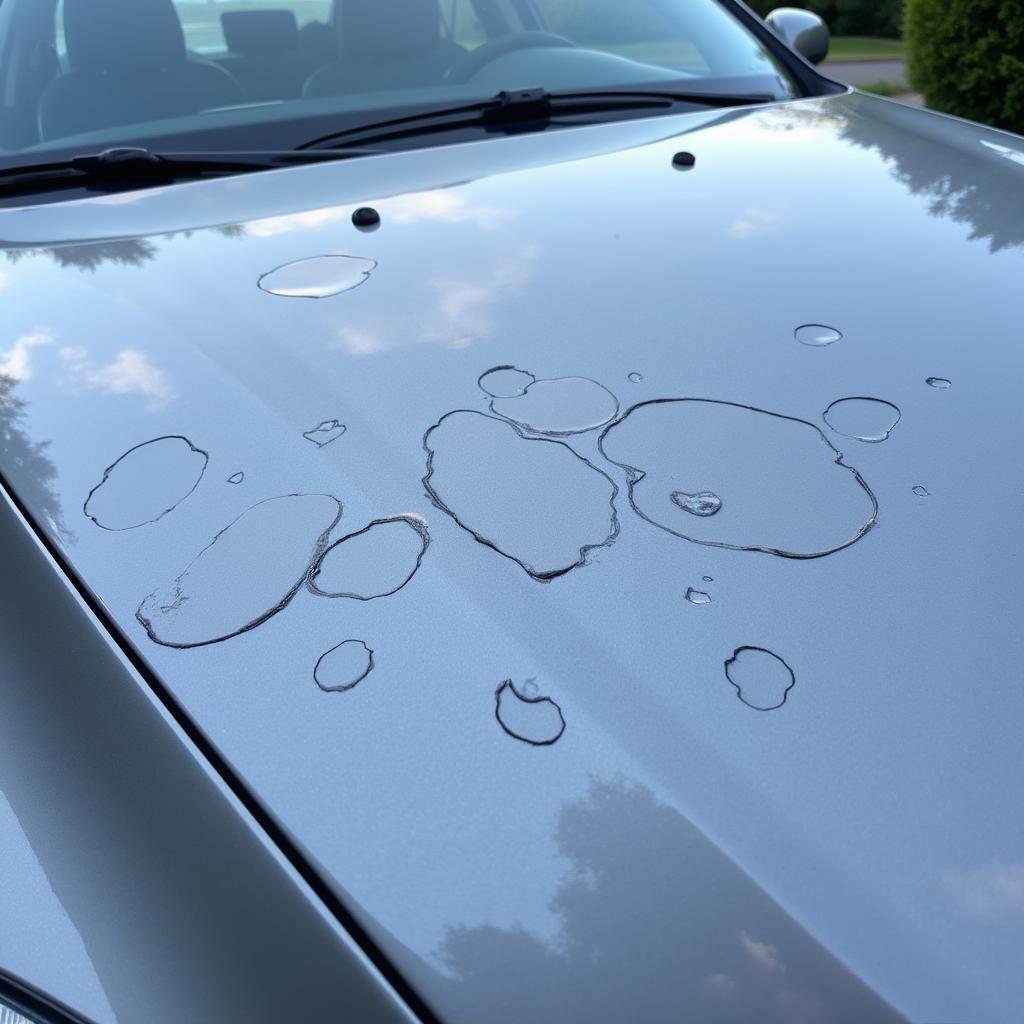

Before you need to use insurance to fix your car, it’s crucial to understand your policy. Different policies offer varying levels of coverage. Knowing what yours covers—collision, comprehensive, liability—will help you determine what expenses your insurance will handle. For example, collision covers damage from accidents, while comprehensive covers damage from events like theft, vandalism, or natural disasters. [how to fix hail damage on car yourself](https://autotippro.com/how-to fix-hail-damage-on-car-yourself/) can be useful if the damage is minor and you want to avoid involving insurance.

Deciding When to Use Insurance for Car Repairs

Sometimes, it’s clear that you need to use your insurance. A major accident, for example, will likely necessitate an insurance claim. However, for minor damage, the decision can be more complex. Consider the cost of repairs versus your deductible. If the repair cost is less than your deductible, using insurance might not be the most cost-effective solution. You might find our guide on the fixed cost of a car helpful when weighing your options.

Filing an Insurance Claim: A Step-by-Step Guide

Filing an insurance claim can feel overwhelming, but taking it step-by-step makes the process more manageable. First, contact your insurance company as soon as possible after the incident. Provide all necessary information, including the date, time, location, and details of the incident. Then, document the damage thoroughly with photos and videos. Finally, obtain a police report if the incident involves another vehicle or significant damage.

Working with the Insurance Adjuster

The insurance adjuster’s role is to assess the damage and determine the repair costs. Be prepared to answer their questions thoroughly and accurately. Don’t hesitate to ask questions about the process and their assessment. Remember, you have the right to negotiate the settlement offer if you feel it’s inadequate. Knowing how much does it cost to fix deep car scratches can help you understand typical repair costs and negotiate effectively.

Choosing a Repair Shop

You typically have the right to choose your own repair shop. While your insurance company may recommend a shop, you are not obligated to use their recommendation. Research different shops, compare quotes, and choose a reputable shop that you trust. Consider factors like experience, certifications, and customer reviews.

Getting Your Car Back on the Road

Once the repairs are complete, thoroughly inspect your vehicle to ensure everything is in order. Don’t hesitate to bring up any concerns with the repair shop. After you’re satisfied, you can finalize the paperwork and get your car back on the road. Knowing about fix my car windshield can be invaluable, especially if you’ve experienced windshield damage.

Conclusion

Using insurance to fix your car can be a complex process, but understanding your policy, filing a claim effectively, and working with a reputable repair shop can simplify the process. Remember, you have the right to advocate for yourself throughout the process to ensure your car is repaired properly. Contact AutoTipPro at +1 (641) 206-8880 or visit our office at 500 N St Mary’s St, San Antonio, TX 78205, United States for further assistance.

“Knowing your insurance policy inside and out is the first step to a smooth claim process,” says John Smith, Automotive Claims Specialist. “Don’t be afraid to ask questions and negotiate for a fair settlement,” adds Jane Doe, Senior Insurance Advisor. “A reputable repair shop can make all the difference in getting your car back to pre-accident condition,” advises David Lee, Master Automotive Technician. heating core for car fix can be a significant expense, so ensuring it’s covered under your policy is essential.

Leave a Reply