Dealing with Insurance Car Flooded Problems can be a nightmare. From assessing the damage to navigating the claims process, this guide provides expert advice to help car owners, repair shops, and technicians tackle the challenges of flood-damaged vehicles.

Insurance Car Flooded Problems: Initial Damage Assessment

Insurance Car Flooded Problems: Initial Damage Assessment

Understanding Insurance Car Flooded Problems

Flooded cars present a unique set of challenges, often resulting in significant mechanical and electrical issues. These problems can range from minor inconveniences to complete engine failure. Understanding the complexities of insurance car flooded problems is crucial for both vehicle owners and professionals in the automotive industry. Flooded cars problems can quickly become overwhelming, leaving owners feeling lost and confused. Knowing what to expect and how to proceed can save you time, money, and a lot of frustration.

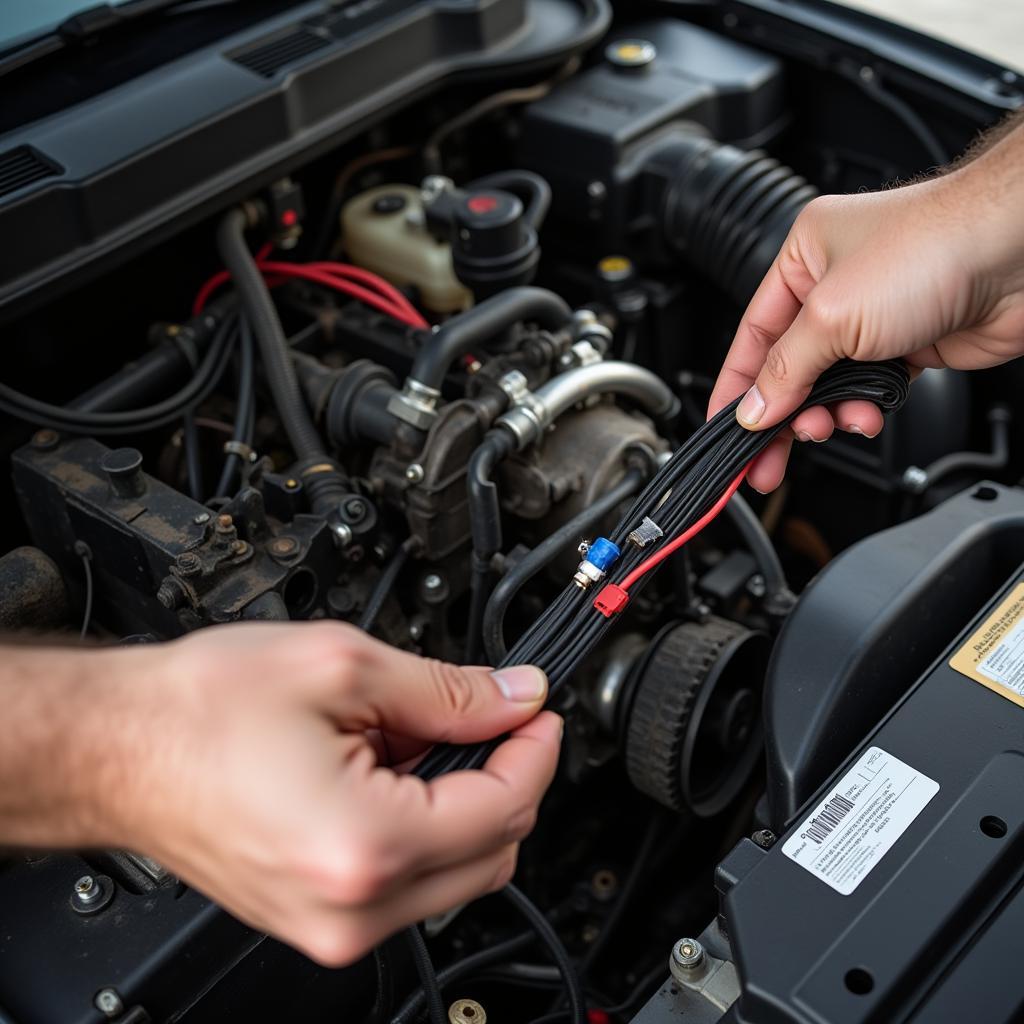

Common Issues with Flood-Damaged Vehicles

Water damage isn’t just about a wet interior. Problems with water damaged cars extend to crucial components like the engine, transmission, and electrical system. Corrosion, mold, and mildew can set in quickly, causing long-term problems. Here are some common issues:

- Electrical System Malfunctions: Water and electricity don’t mix. Expect shorts, blown fuses, and malfunctioning electronic components.

- Engine Damage: Water can hydrolock an engine, causing irreparable damage.

- Transmission Problems: Water contamination in the transmission fluid can lead to slippage and eventual failure.

- Brake System Issues: Water can corrode brake lines and components, compromising braking performance.

- Interior Damage: Mold and mildew growth can create health hazards and unpleasant odors.

“Flood damage is often more than meets the eye,” says John Miller, a certified automotive technician with over 20 years of experience. “Hidden corrosion and electrical issues can surface months after the initial flood event.”

Navigating the Insurance Claim Process

Dealing with insurance after a flood can be complicated. Knowing your policy and understanding the claims process is vital.

Steps to File a Claim for Insurance Car Flooded Problems

- Contact your insurance company immediately. Report the damage and provide all necessary information.

- Document the damage. Take photos and videos of the affected areas.

- Get a professional assessment. Have a qualified mechanic inspect the vehicle and provide a detailed damage report.

- Review your policy. Understand your coverage and deductible.

- Negotiate with the insurance adjuster. Be prepared to discuss the repair costs and potential settlement options.

If you car is flooded what problem can result is a common question among car owners after a flood. The answer, unfortunately, is a complex one with many potential issues arising.

Understanding Your Insurance Coverage for Flood Damage

Not all insurance policies cover flood damage. Problems with electric power car in flood and emergency areas highlight the increasing need for comprehensive coverage. Make sure you have the right type of coverage to protect your investment.

“Understanding your insurance policy is the first step in a smooth claims process,” advises Sarah Johnson, an insurance claims specialist. “Knowing what’s covered and what’s not can save you from unexpected expenses.”

Insurance Claim Paperwork for Flooded Car

Insurance Claim Paperwork for Flooded Car

Preventing Future Insurance Car Flooded Problems

While you can’t always prevent floods, you can take steps to minimize the risk of damage to your vehicle.

- Park in elevated areas. Avoid parking in low-lying areas prone to flooding.

- Move your car to higher ground. If a flood is imminent, move your car to a safe location.

- Invest in flood barriers. These barriers can help protect your property from rising floodwaters.

Conclusion

Insurance car flooded problems can be challenging, but with the right knowledge and preparation, you can navigate the process effectively. Understanding your insurance policy, documenting the damage thoroughly, and seeking professional advice are crucial steps in ensuring a successful claim. Contact AutoTipPro at +1 (641) 206-8880 or visit our office at 500 N St Mary’s St, San Antonio, TX 78205, United States for expert assistance. Don’t let insurance car flooded problems overwhelm you – we’re here to help. Problems with ethanol fuel in cars can also arise after flooding, adding another layer of complexity to the situation.

Leave a Reply