Buying a car with incentives can feel like solving a complex math problem. Rebates, discounts, financing offers—how do you make sense of it all and ensure you’re getting the best deal? This article will break down the process, providing you with the tools and knowledge to navigate the often confusing world of car incentives and drive away confidently in your new vehicle.

Decoding Car Incentives: Your Guide to Savings

Car incentives are a powerful tool for buyers, but understanding them is key. They can significantly reduce the overall cost of your vehicle, but the variety of offers can be overwhelming. Let’s explore the most common types of incentives:

- Rebates: These are cash-back offers from the manufacturer, often applied directly to your down payment, reducing the amount you need to finance.

- Discounts: These are price reductions applied directly to the vehicle’s sticker price.

- Financing Incentives: These can include low APR (Annual Percentage Rate) offers or special lease deals, potentially saving you a substantial amount on interest payments over the loan term.

Calculating the True Cost: Buying a Car with Incentives Math Problem Solved

The “Buying A Car With Incentives Math Problem” arises when trying to determine the best combination of offers. Here’s a step-by-step approach to help you solve it:

- Determine Your Needs and Budget: Before considering incentives, know what type of car you need and how much you can afford.

- Research Available Incentives: Check manufacturer websites and dealership promotions for current offers.

- Compare Offers: Don’t just focus on the biggest rebate. A low APR might save you more money in the long run.

- Negotiate: Incentives are a starting point. Don’t be afraid to negotiate the price further.

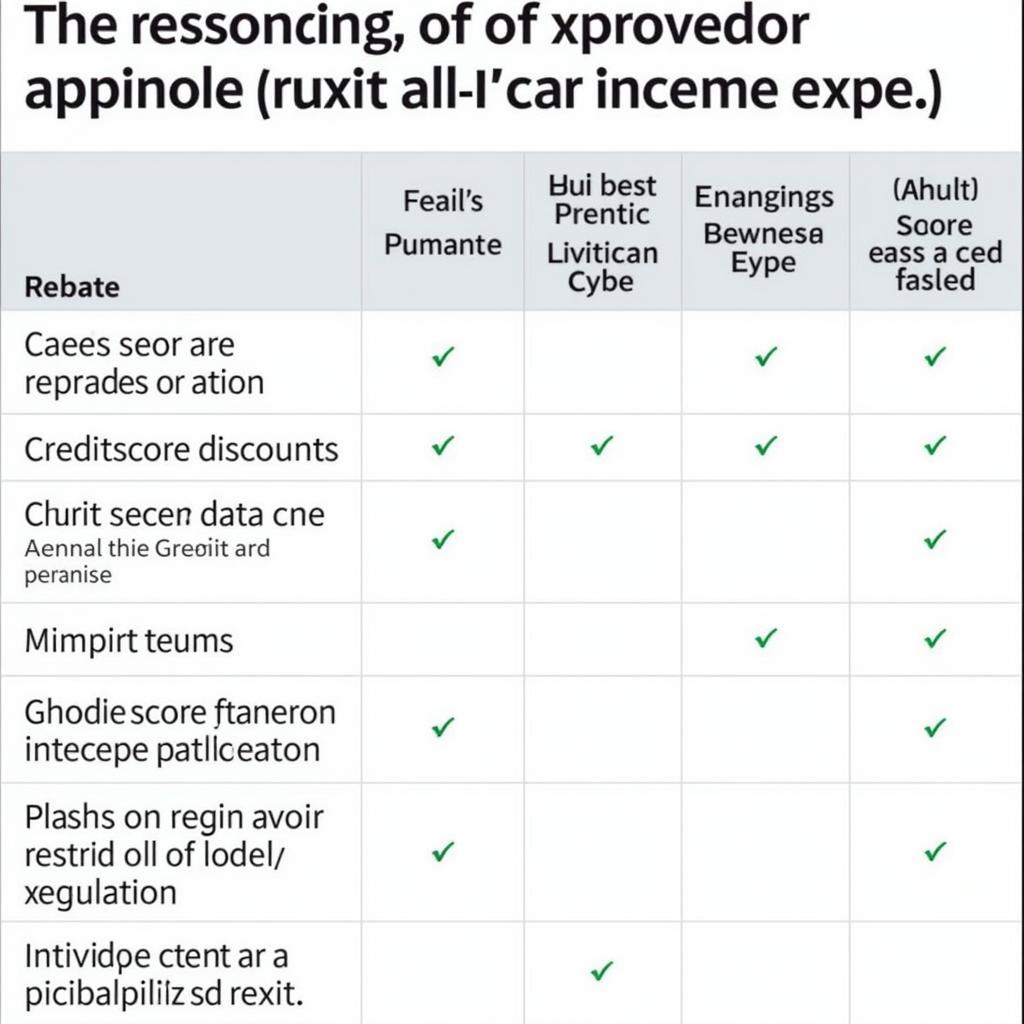

Navigating the Fine Print: Understanding Incentive Restrictions

When buying a car with incentives, it’s crucial to understand the fine print. Some incentives might have specific requirements, such as:

- Credit Score Requirements: Low APR financing often requires excellent credit.

- Model Restrictions: Some incentives may only apply to specific models or trim levels.

- Time Limits: Incentives typically have expiration dates, so act fast.

Car Incentive Restrictions Explained

Car Incentive Restrictions Explained

“Understanding the details of incentives is paramount. Don’t be swayed by a large rebate if you don’t qualify for it,” advises automotive expert, Dr. Emily Carter, PhD in Automotive Engineering.

Making the Best Decision: Your Car Buying Strategy

To optimize your car buying strategy with incentives, consider these tips:

- Compare Dealers: Different dealerships might offer different incentive packages.

- Calculate Total Cost of Ownership: Consider not just the purchase price, but also factors like fuel efficiency, insurance, and maintenance.

- Don’t Rush: Take your time to research and compare before making a decision.

“Patience is key when navigating the car buying process. A well-informed buyer is a empowered buyer,” adds automotive industry consultant, Mr. David Miller, Automotive Market Analyst at JD Power.

Buying a Car with Incentives Math Problem: Conclusion

Buying a car with incentives can be a smart way to save money, but requires careful consideration. By understanding the different types of incentives, calculating the true cost, and navigating the fine print, you can confidently navigate the buying process and drive away with a great deal. For further assistance or personalized advice, connect with AutoTipPro at +1 (641) 206-8880 or visit our office at 500 N St Mary’s St, San Antonio, TX 78205, United States. We’re here to help you solve the “buying a car with incentives math problem.”

FAQ

- What is the difference between a rebate and a discount?

- How do I find current car incentives?

- Do I need good credit to qualify for financing incentives?

- Can I combine different incentives?

- What is the best time of year to buy a car with incentives?

- How do I negotiate the price of a car with incentives?

- What are the common pitfalls to avoid when buying a car with incentives?

Leave a Reply