Understanding Car Fuel And Maintenance Allowance Income Tax can be tricky. This guide will break down everything you need to know, from what it is to how it impacts your taxes and how to maximize potential benefits. We’ll cover key aspects of claiming allowances, common pitfalls, and expert advice to ensure you’re making the most of your car-related expenses. personal car fuel and maintenance allowance income tax

What is a Car Fuel and Maintenance Allowance?

A car fuel and maintenance allowance is a payment made by an employer to an employee to cover the costs of using their personal vehicle for business purposes. This allowance covers fuel and maintenance expenses, such as oil changes, tire rotations, and repairs. It’s important to understand how this allowance is treated for tax purposes to ensure you’re compliant with regulations and optimizing your financial situation.

How Does Car Fuel and Maintenance Allowance Affect Income Tax?

The tax implications of a car fuel and maintenance allowance depend on whether the allowance is considered taxable or non-taxable. A taxable allowance is added to your gross income and is subject to income tax withholding. A non-taxable allowance, also known as an accountable plan, is not considered income as long as you meet certain requirements, such as substantiating your expenses.

Car Fuel and Maintenance Allowance Income Tax: Claiming the Right Way

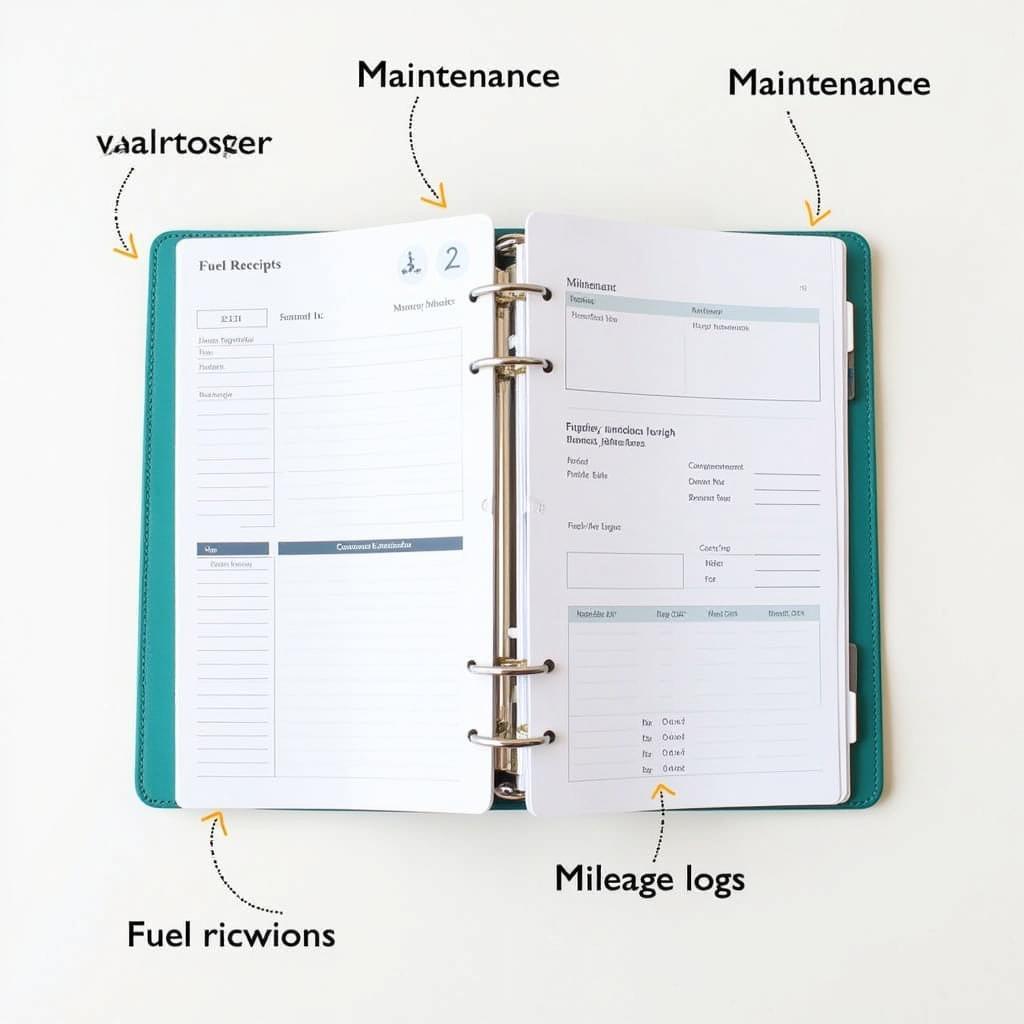

Claiming your car fuel and maintenance allowance correctly is crucial to minimize your tax burden. Keep detailed records of all your business-related car expenses, including mileage, fuel costs, and maintenance receipts. Understanding the specific regulations in your jurisdiction is also vital, as rules may vary.

what is car maintenance allowance

Accurate Record Keeping for Car Expenses

Accurate Record Keeping for Car Expenses

Common Mistakes to Avoid with Car Fuel and Maintenance Allowance

One common mistake is not keeping accurate records. This can lead to issues during a tax audit and potentially result in penalties. Another mistake is assuming your allowance is automatically non-taxable. Always verify with your employer or a tax professional to confirm the specific tax treatment of your allowance. Misclassifying personal mileage as business mileage is another pitfall to avoid.

Car Maintenance Allowance Exemption Section: Navigating the Complexities

Understanding the specific exemption sections of the tax code related to car maintenance allowance is essential. These sections outline the criteria for qualifying for tax-free reimbursement and the documentation required to support your claims. car maintenance allowance exemption section

“Properly documenting your expenses is the cornerstone of a successful claim,” says John Smith, a certified automotive engineer with over 20 years of experience. “Failing to do so can lead to unnecessary tax liabilities.”

Maximizing Your Car Fuel and Maintenance Allowance Benefits

To maximize your benefits, consider using fuel-efficient driving techniques and keeping your vehicle well-maintained. Regular maintenance can reduce fuel consumption and prevent costly repairs down the line. Additionally, familiarize yourself with the latest tax regulations to ensure you are taking advantage of all applicable deductions and credits.

“Staying informed about changes in tax laws is crucial,” adds automotive consultant Jane Doe. “Regularly reviewing IRS publications or consulting with a tax professional can help you optimize your tax strategy.”

Conclusion

Understanding car fuel and maintenance allowance income tax is essential for both employers and employees. By following the guidelines outlined in this guide, you can ensure compliance, minimize tax liabilities, and maximize your benefits. Remember to keep accurate records, understand the applicable tax laws, and seek professional advice when needed. For personalized assistance with car fuel and maintenance allowance income tax, connect with us at Autotippro. Our office is located at 500 N St Mary’s St, San Antonio, TX 78205, United States, and you can reach us by phone at +1 (641) 206-8880.

FAQ

-

What are the tax implications of a car fuel and maintenance allowance?

The tax implications depend on whether the allowance is taxable or non-taxable. -

How can I claim my car fuel and maintenance allowance?

Keep detailed records of your expenses, including mileage, fuel costs, and maintenance receipts. -

What are some common mistakes to avoid?

Not keeping accurate records and assuming your allowance is automatically non-taxable are common mistakes. -

Where can I find information on car maintenance allowance exemption sections?

Refer to the relevant tax code or consult with a tax professional. -

How can I maximize my car fuel and maintenance allowance benefits?

Use fuel-efficient driving techniques, maintain your vehicle regularly, and stay informed about tax regulations. -

What is an accountable plan?

An accountable plan is a non-taxable allowance where expenses are substantiated. -

Where can I get help with car fuel and maintenance allowance income tax?

Contact AutoTipPro for personalized assistance.

Leave a Reply