Claiming Car Maintenance Tax can be a confusing process. This guide provides a detailed overview of deductible car maintenance expenses, helping you maximize your tax savings. We’ll explore eligible expenses, documentation requirements, and common misconceptions. Learn how to navigate the complexities of car maintenance tax deductions and keep more money in your pocket.

Understanding Deductible Car Maintenance Expenses

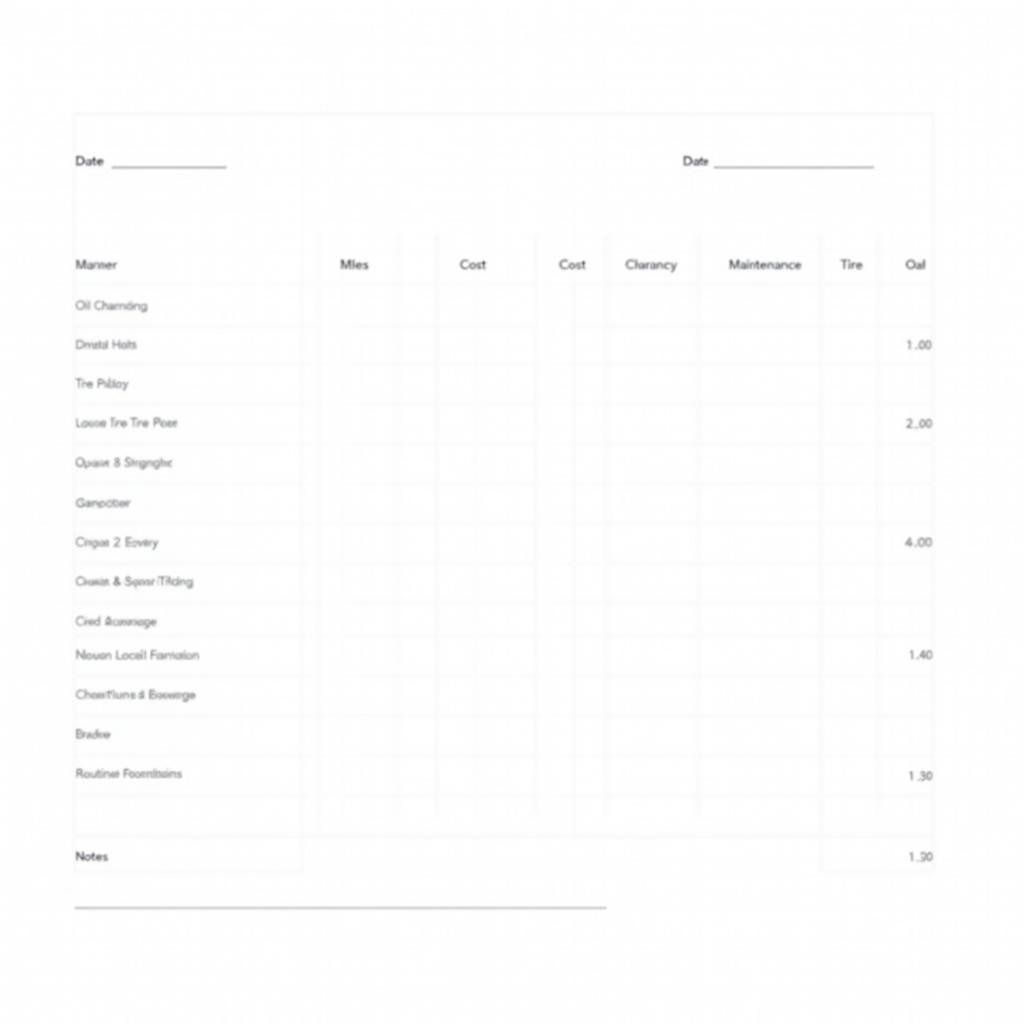

What car maintenance expenses are tax deductible? This is a common question for car owners. Generally, you can deduct car maintenance expenses if you use your vehicle for business purposes. what is considered as car maintenance irs. These expenses fall under the category of business expenses and can significantly reduce your tax burden. Examples of deductible expenses include oil changes, tire rotations, brake repairs, and other routine maintenance.

Keeping accurate records is crucial for claiming car maintenance tax deductions. You’ll need to maintain detailed records of all expenses, including receipts, invoices, and canceled checks. These documents should clearly indicate the date, amount, and type of service performed.

Maximizing Your Tax Savings: Strategies for Claiming Car Maintenance Tax

Are you looking to maximize your tax savings? Consider using mileage tracking apps and software. These tools can automatically track your business mileage and calculate your deductible expenses, simplifying the record-keeping process. [car maintenance bill with gst](https://autotippro.com/car maintenance-bill-with-gst/). This helps ensure accuracy and avoids potential issues during audits.

Another important aspect of claiming car maintenance tax is understanding the difference between repairs and improvements. Repairs are generally deductible, while improvements, which increase the value of your vehicle, are typically capitalized and depreciated over time.

Common Misconceptions about Car Maintenance Tax Deductions

One common misconception is that all car maintenance expenses are deductible. This is not true. Only expenses related to business use are deductible. maintenance cost of different indian cars. Personal car maintenance expenses are not tax deductible.

Another misconception is that you don’t need detailed records if you use the standard mileage rate. While the standard mileage rate simplifies calculations, you still need to maintain records of your business mileage.

“Accurate record-keeping is the cornerstone of a successful tax strategy,” says automotive expert, John Smith, ASE Certified Master Technician. “Without proper documentation, you risk losing out on valuable deductions.”

Claiming Car Maintenance Tax for Business Use

If you use your car for both business and personal use, you can only deduct the portion of your expenses related to business use. You’ll need to calculate the percentage of business use and apply it to your total car maintenance expenses. india car maintenance deduction. This requires accurate mileage tracking.

“Don’t underestimate the value of consulting with a tax professional,” advises Sarah Jones, CPA. “They can provide personalized guidance and ensure you’re taking advantage of all available deductions.” car maintenance tax exempt. This is particularly important for complex situations involving business use of a vehicle.

Conclusion

Claiming car maintenance tax can seem daunting, but with the right knowledge and preparation, you can effectively maximize your tax savings. Remember to keep meticulous records, differentiate between repairs and improvements, and understand the rules regarding business use. By following these guidelines, you can confidently navigate the complexities of car maintenance tax deductions and keep more of your hard-earned money. For further assistance, connect with us at AutoTipPro. Call us at +1 (641) 206-8880 or visit our office at 500 N St Mary’s St, San Antonio, TX 78205, United States. We’re here to help!

Leave a Reply