Understanding the Difference Between Fixed And Variable Car Loans is crucial when financing your next vehicle. This decision significantly impacts your monthly payments and the total cost of your loan. Choosing the right loan type depends on your financial situation and risk tolerance. Let’s explore the key distinctions to help you make an informed decision.

After reading this comprehensive guide on the difference between fixed and variable car loans, you will be equipped with the knowledge to confidently navigate the car financing process. We’ll cover everything from interest rate fluctuations to long-term cost implications.

Fixed vs. Variable Car Loans: Interest Rates

The primary difference between fixed and variable car loans lies in their interest rates. A fixed-rate loan maintains the same interest rate throughout the loan term, providing predictable monthly payments. Conversely, a variable-rate loan has an interest rate that fluctuates based on market conditions, typically tied to an index like the prime rate.

With a fixed-rate loan, you know exactly how much to budget each month, regardless of economic changes. This stability can be particularly appealing for those who prioritize predictable expenses. However, if interest rates drop significantly, you won’t benefit from lower monthly payments.

Variable-rate loans offer the potential for lower interest rates and, consequently, lower monthly payments if market rates decline. However, this comes with the risk of increased payments if rates rise. This uncertainty can make budgeting challenging. Learning about the difference between fixed and variable car loans helps you understand these nuances.

Which Loan Type is Right for You?

Choosing between a fixed and variable car loan depends on several factors. If you prefer predictable payments and peace of mind, a fixed-rate loan is generally the better option. This allows you to budget effectively, knowing your car payment will remain consistent. For more information on this, check out the difference between fixed and variable car loan.

If you’re comfortable with some level of risk and believe interest rates are likely to fall, a variable-rate loan could save you money in the long run. However, be prepared for potential increases in your monthly payments if rates rise. This is a crucial consideration when understanding the difference between fixed and variable car loans.

“Choosing the right car loan is a critical financial decision,” says automotive financial expert, Amelia Carter, CFA. “Understanding your individual financial situation and risk tolerance is key to selecting the best loan type for your needs.”

Long-Term Cost Considerations

When comparing fixed and variable car loans, it’s important to consider the long-term cost implications. While a variable-rate loan might offer lower initial payments, rising interest rates could ultimately lead to a higher overall cost than a fixed-rate loan. Conversely, if rates remain low or decline, a variable-rate loan could save you money. You can learn more about how these factors affect the difference between fixed and variable car loan.

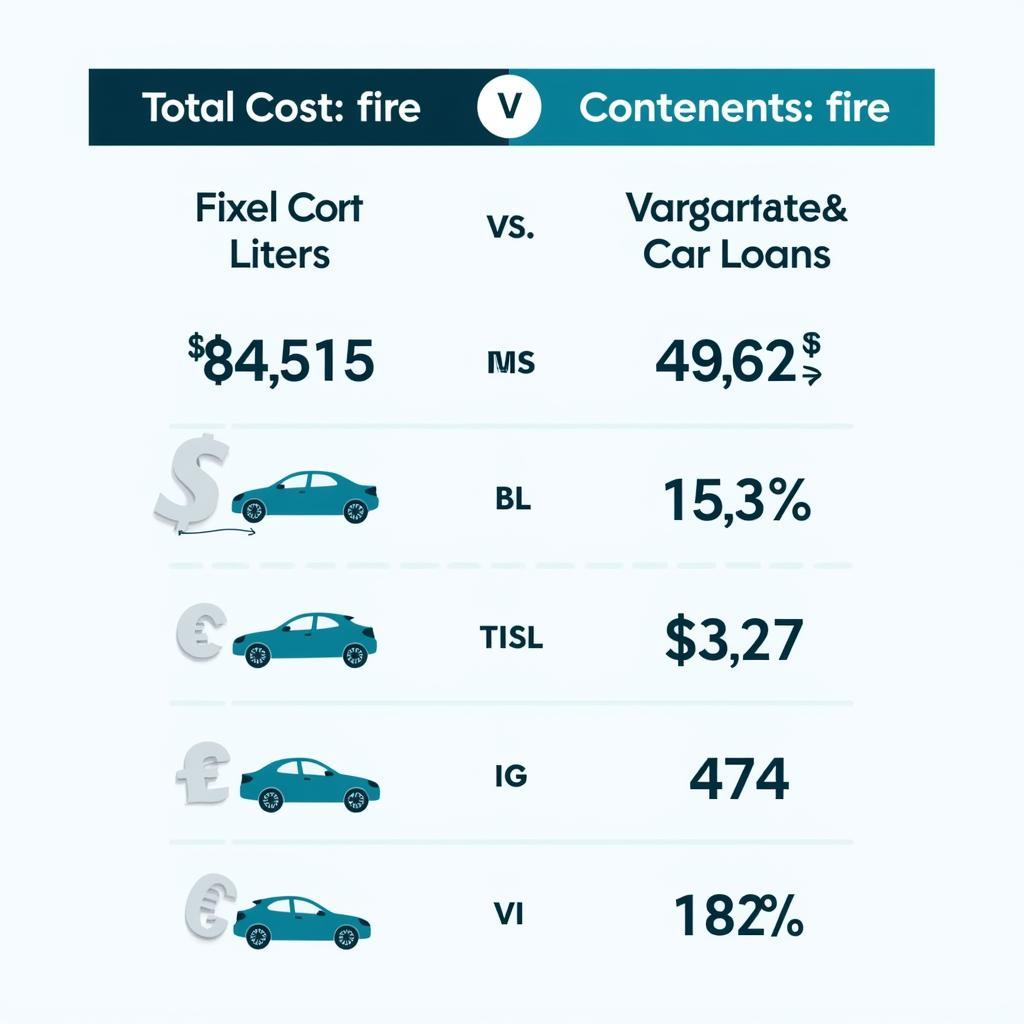

Long-Term Car Loan Cost Comparison Chart

Long-Term Car Loan Cost Comparison Chart

Understanding Loan Terms and Fees

Regardless of whether you choose a fixed or variable rate, be sure to thoroughly understand the loan terms, including the loan length, any associated fees, and prepayment penalties. Longer loan terms result in lower monthly payments but higher overall interest paid. Carefully review all loan documents and ask questions before signing. The difference between fixed and variable car loan also extends to these aspects.

Navigating the Car Loan Landscape

The car financing process can be complex, but with a clear understanding of the difference between fixed and variable car loans, you can make an informed choice that aligns with your financial goals. To learn more about fixed and variable car loans, refer to this detailed comparison of the difference between fixed and variable car loan.

“Don’t rush into a car loan without doing your research,” advises David Miller, a senior auto loan specialist. “Compare offers from multiple lenders to ensure you’re getting the best possible terms.”

Conclusion

Understanding the difference between fixed and variable car loans is essential for making a sound financial decision. By carefully weighing the pros and cons of each loan type and considering your personal financial situation, you can choose the loan that best fits your needs and budget. For more information, you can always consult the difference between fixed and variable car loan guide. Contact us at AutoTipPro for expert advice and assistance with your car financing needs. Our phone number is +1 (641) 206-8880, and our office is located at 500 N St Mary’s St, San Antonio, TX 78205, United States.

FAQ

-

What is the main difference between fixed and variable car loans? The primary difference lies in the interest rate: fixed rates remain constant, while variable rates fluctuate with market conditions.

-

Which loan type is better? There’s no universally “better” loan type. The best choice depends on individual financial circumstances and risk tolerance.

-

Can I refinance a variable-rate car loan to a fixed-rate loan? Yes, refinancing is often possible, but it’s essential to compare costs and terms before making a decision.

-

What factors influence variable interest rates? Variable rates are typically tied to a benchmark index, such as the prime rate, which fluctuates based on market conditions.

-

Are there any fees associated with car loans? Yes, car loans often come with various fees, including origination fees, application fees, and prepayment penalties. Be sure to inquire about these fees before signing any loan documents.

-

How does loan term length affect my monthly payments? Longer loan terms result in lower monthly payments but higher overall interest paid.

-

Where can I get more information on car loans? You can explore the difference between fixed and variable car loan for a comprehensive understanding. Also, consult with a financial advisor or auto loan specialist for personalized guidance.

Leave a Reply