Engine computer problems can be a real headache, both financially and logistically. And if you’re wondering, “Does Car Insurance Cover Engine Computer Problems?”, the answer isn’t always straightforward. Let’s dive into the complexities of car insurance coverage and how it relates to those pesky engine control units (ECUs). After reading this article, you should have a clearer understanding of your coverage and what to expect when those digital gremlins strike.

Damaged ECU in a Car Engine

Damaged ECU in a Car Engine

Engine control modules (ECMs), also known as powertrain control modules (PCMs) or engine control units (ECUs), are the brains of your car’s engine. They manage a plethora of functions, from fuel injection and ignition timing to emissions control. When they malfunction, it can lead to a range of issues, from poor performance and reduced fuel economy to complete engine failure. Naturally, you might assume your car insurance would cover these issues. However, it depends heavily on your policy and the specific circumstances.

Understanding Your Car Insurance Policy and ECU Coverage

Most basic car insurance policies cover physical damage to your vehicle caused by events like collisions, theft, fire, and vandalism. This is where things get tricky with ECUs. If your engine computer is damaged in a covered incident, such as a car accident that resulted in transmission problems after car accident, your insurance might cover the replacement cost. However, if the damage is due to wear and tear, a manufacturing defect, or a rodent infestation (yes, it happens!), your insurance is unlikely to cover it. These situations are generally considered maintenance issues, not sudden, accidental damage. Think of it like your tires; insurance won’t cover replacing worn-out tires, but they will likely cover tire damage from a pothole you hit on a covered road.

Does Comprehensive Coverage Cover Engine Computer Issues?

Comprehensive coverage is an optional add-on to your car insurance policy that covers damage not caused by a collision. This includes things like fire, theft, vandalism, and even falling objects. If your engine computer is damaged due to one of these covered perils, your comprehensive coverage will likely cover the cost of replacement, minus your deductible. However, comprehensive coverage still won’t cover damage due to wear and tear or mechanical breakdown.

Common Causes of Engine Computer Problems and Insurance Implications

Engine computer problems can stem from various sources. Here’s a breakdown of some common causes and their potential insurance implications:

- Physical Damage: If your ECU is damaged in a collision, your collision coverage will typically handle the repair or replacement cost.

- Water Damage: Driving through floodwaters can damage your ECU. Comprehensive coverage often covers water damage, but check your policy specifics.

- Electrical Issues: A short circuit or power surge can fry your ECU. This may or may not be covered, depending on the cause of the electrical problem and your policy.

- Rodent Damage: Surprisingly common! Chewing wires can lead to ECU malfunction. This is generally not covered by insurance, as it’s considered a preventable maintenance issue. If you have experienced problems with my car, it is important to find the root of the issue.

- Software Glitches: Sometimes, the software within the ECU can become corrupted. This is usually not covered by insurance and would require a reprogramming or replacement by a qualified mechanic.

How to Diagnose Engine Computer Problems

Identifying engine computer problems can be tricky. Symptoms can range from illuminated check engine lights and erratic engine behavior to complete engine failure. If you suspect your ECU is acting up, it’s crucial to have it diagnosed by a qualified mechanic with the appropriate diagnostic tools.

Tips for Preventing Engine Computer Problems

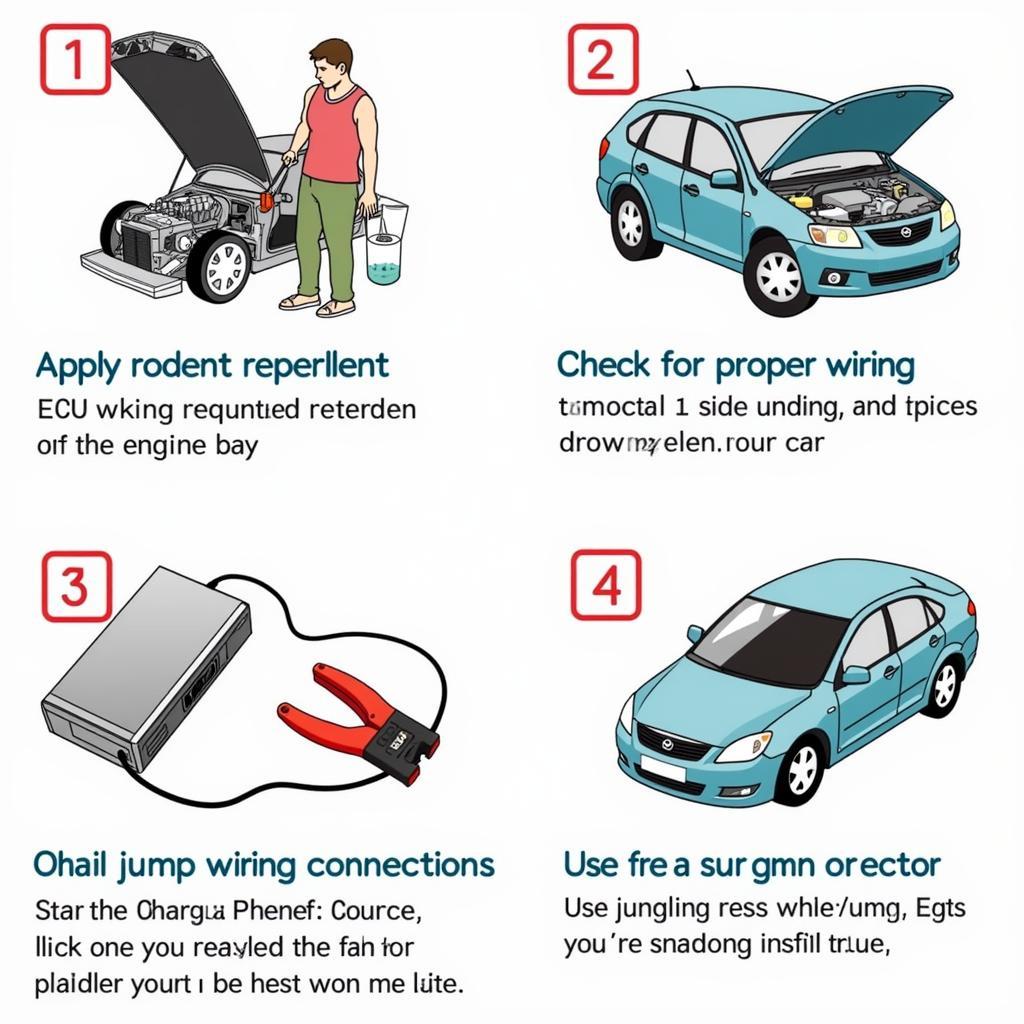

While not all ECU problems are preventable, some proactive steps can help minimize the risk:

- Regular Maintenance: Keep your car’s electrical system in good condition. Regular checks and addressing any wiring issues can prevent potential problems.

- Avoid Driving Through Floodwaters: Water and electronics don’t mix!

- Protect Against Rodents: Use rodent repellent or seal any potential entry points to your car’s engine compartment.

- Use a Surge Protector: When jump-starting your car, use a surge protector to avoid damaging the ECU.

“Protecting your vehicle’s engine computer is about more than just insurance coverage; it’s about preventative maintenance and understanding the potential risks,” advises Robert Anderson, Automotive Engineer at Future Auto Solutions.

Preventing ECU Damage in Cars

Preventing ECU Damage in Cars

What if the Metromile Plug Causes Problems?

Some devices, like the Metromile Pulse plug, can sometimes cause car issues, though it’s rare. If you suspect the metromile plug causes car problems, have a mechanic inspect it.

Conclusion

So, does car insurance cover engine computer problems? The answer is: it depends. While comprehensive and collision coverage may cover ECU damage caused by certain perils, it typically won’t cover problems stemming from wear and tear, mechanical breakdown, or rodent damage. Understanding your policy and taking preventative measures can save you time, money, and frustration down the road. For more information or assistance with automotive issues, feel free to connect with us at AutoTipPro. You can reach us at +1 (641) 206-8880 or visit our office at 500 N St Mary’s St, San Antonio, TX 78205, United States.

“Always review your car insurance policy carefully. Understanding your coverage is key to avoiding surprises when unexpected issues arise,” says Susan Miller, Senior Insurance Analyst at Auto Protect Group.

Leave a Reply