Fixed annuities with long term care riders offer a way to prepare for potential future long-term care needs while also providing a guaranteed stream of income. These products have gained popularity, but it’s crucial to understand both the advantages and disadvantages before making a decision. This article will delve into the Fixed Annuity With Long Term Care Rider Pros And Cons to help you make an informed choice.

Understanding Fixed Annuities and Long Term Care Riders

A fixed annuity is a contract with an insurance company where you deposit money, and they guarantee a fixed interest rate over a specific period. This provides a predictable income stream, making it attractive for retirement planning. A long-term care rider is an optional add-on to the annuity that allows you to access funds for qualified long-term care expenses, such as nursing home care, assisted living, or in-home care.

Fixed Annuity with Long Term Care Rider Pros

These combination products offer several compelling benefits. One key advantage is the potential to leverage your investment. Your annuity’s value can grow tax-deferred, and the long-term care rider can multiply those benefits when you need them. Imagine needing care and having access to two or three times your initial investment for qualified expenses. Another advantage is simplified financial planning. Instead of managing separate accounts for retirement and long-term care, you have a single, integrated solution.

Fixed Annuity with Long Term Care Rider Cons

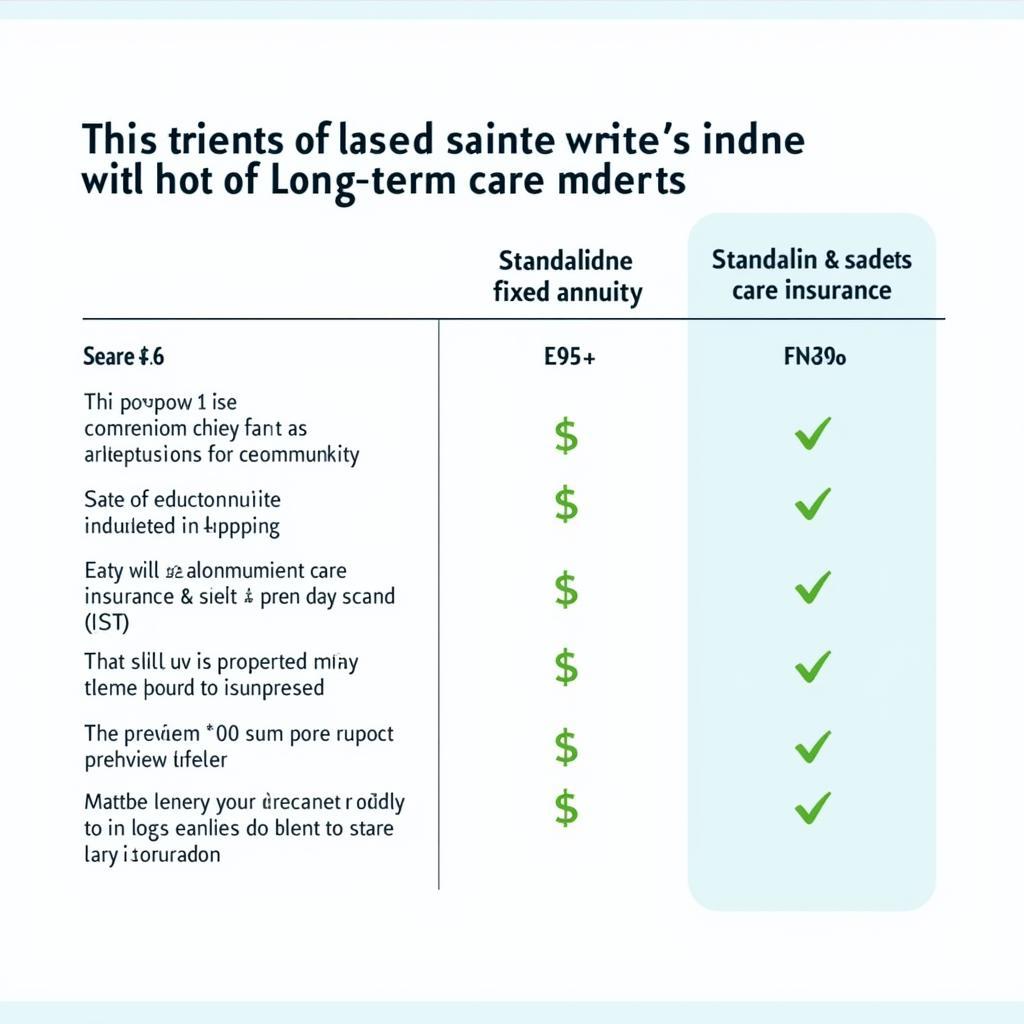

While the pros are enticing, it’s equally important to consider the cons. One potential downside is the cost. Long-term care riders add to the overall expense of the annuity. You’ll want to carefully compare costs with stand-alone long-term care insurance. Another consideration is the complexity of these products. The terms and conditions can be intricate, making it essential to thoroughly understand the policy before committing. What are the specific qualifications for accessing benefits? What types of care are covered? These are questions you need to ask.

Costs of Fixed Annuity with Long Term Care Rider

Costs of Fixed Annuity with Long Term Care Rider

Is a Fixed Annuity with a Long Term Care Rider Right for You?

The decision depends on your individual circumstances and financial goals. Factors to consider include your age, health, existing assets, and risk tolerance. If you’re seeking a simplified approach to retirement and long-term care planning and are comfortable with the costs and terms, this combination product could be a viable option.

Fixed Annuity with Long Term Care Rider: Expert Opinions

“A fixed annuity with a long-term care rider can be a good choice for someone who wants peace of mind knowing that they have a plan in place for both retirement and long-term care,” says John Smith, Certified Financial Planner at ABC Financial. “However, it’s important to understand the costs and benefits before making a decision.” Jane Doe, a Certified Financial Planner at XYZ Financial Group, adds, “These products can be complex, so it’s crucial to work with a financial advisor who can explain the details and help you determine if it’s the right fit for your needs.”

Financial Consultation for Fixed Annuity with Long Term Care Rider

Financial Consultation for Fixed Annuity with Long Term Care Rider

Conclusion

A fixed annuity with a long term care rider offers a combined approach to retirement and long-term care planning. While it provides potential benefits like leveraged growth and simplified management, it’s crucial to weigh the costs and complexities. Carefully consider your financial situation and consult with a qualified financial advisor to determine if a fixed annuity with a long term care rider is the right choice for you. Connect with AutoTipPro for expert guidance. Call us at +1 (641) 206-8880 or visit our office at 500 N St Mary’s St, San Antonio, TX 78205, United States.

Leave a Reply