Fixed annuities with long-term care riders offer a compelling way to plan for both retirement income and potential long-term care expenses. These financial products combine the guaranteed income stream of a fixed annuity with the added benefit of accessing funds for long-term care needs, providing a sense of security for your future.

Understanding Fixed Annuities with Long-Term Care Riders

Fixed annuities are contracts between you and an insurance company where you deposit a lump sum of money, and in return, the insurance company guarantees a fixed rate of return over a specific period. A long-term care rider is an added feature that allows you to access a portion of your annuity’s value, often tax-free, to pay for qualified long-term care expenses. This can be a significant advantage as it can help protect your retirement savings from being depleted by unexpected long-term care costs.

What are the Benefits of Fixed Annuities with Long-Term Care Riders?

- Guaranteed Income Stream: Enjoy a consistent stream of income during retirement.

- Long-Term Care Coverage: Access funds to cover the costs of long-term care services, such as nursing home care, assisted living, or in-home care.

- Tax Advantages: Withdrawals for qualified long-term care expenses are often tax-free.

- Asset Protection: Depending on state laws, your annuity may be protected from creditors.

- Peace of Mind: Know that you have a plan in place to address potential future long-term care needs.

How Do Fixed Annuities with Long-Term Care Riders Work?

The mechanics of these annuities are relatively straightforward. You purchase a fixed annuity and add the long-term care rider. If you later require long-term care, you can access a multiple of your initial investment for those expenses. For example, a 3x multiplier on a $100,000 annuity would give you access to $300,000 for qualified long-term care costs. The specifics of the rider, like the multiplier and eligibility criteria, vary depending on the insurance company and policy.

Choosing the Right Fixed Annuity with a Long-Term Care Rider

Selecting the right annuity requires careful consideration of your individual circumstances. Factors such as your age, health, retirement goals, and financial situation should all play a role in your decision. It’s crucial to compare different policies from various insurance companies and carefully review the terms and conditions of each rider.

What to Look for in a Long-Term Care Rider

- Elimination Period: The waiting period before benefits are paid.

- Benefit Period: The length of time benefits are paid.

- Inflation Protection: Options for increasing benefits over time to keep pace with rising healthcare costs.

- Multiplier: The multiple of your initial investment you can access for long-term care.

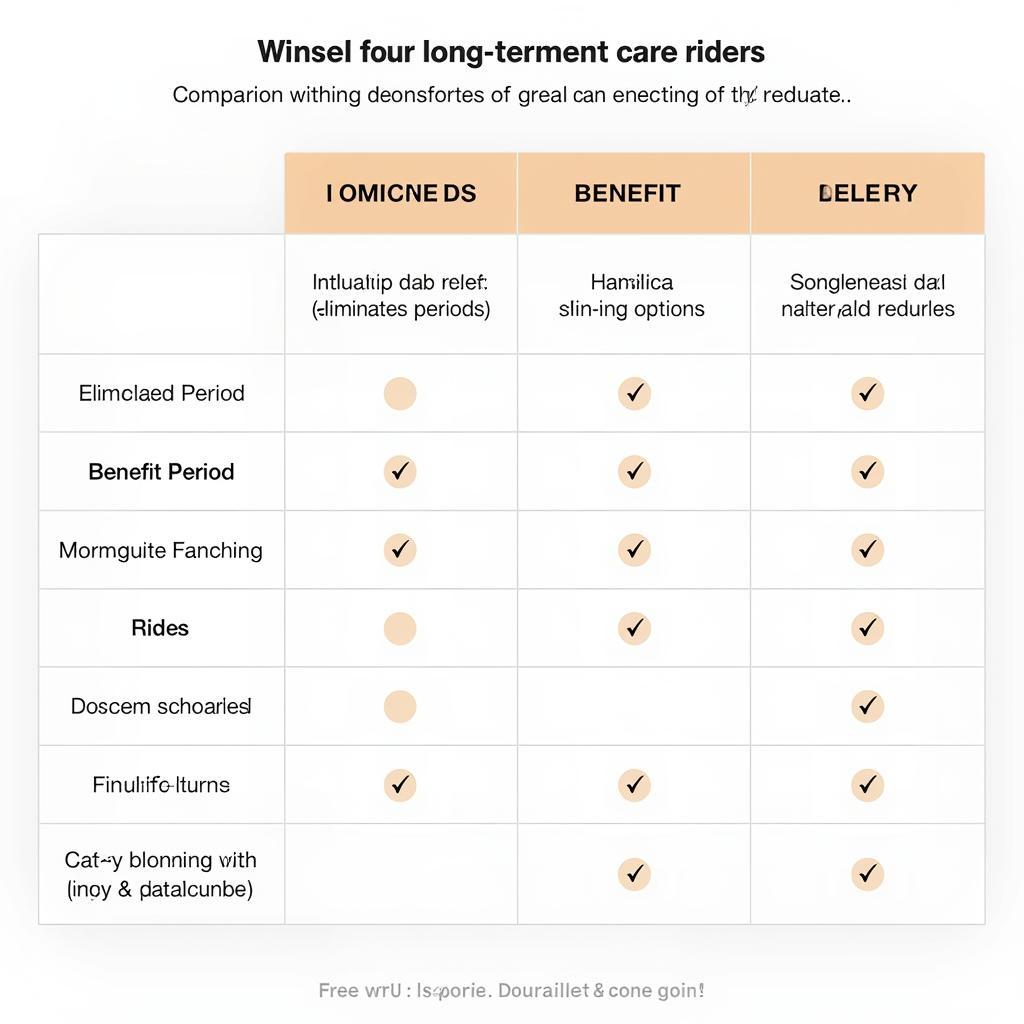

Comparing Long-Term Care Riders

Comparing Long-Term Care Riders

“A well-chosen long-term care rider can provide significant financial security,” says John Smith, a Certified Financial Planner at ABC Financial. “It’s important to work with a qualified advisor to determine if it’s the right fit for your overall retirement plan.”

Is a Fixed Annuity with a Long-Term Care Rider Right for You?

Fixed annuities with long-term care riders are not one-size-fits-all. They are best suited for individuals who want a guaranteed income stream in retirement and are also concerned about potential long-term care expenses. If you are comfortable with the illiquidity of annuities and are seeking a way to combine retirement planning with long-term care coverage, this may be a suitable option for you.

“It’s crucial to understand the trade-offs before investing in any annuity product,” adds Jane Doe, a Retirement Planning Specialist at XYZ Advisors. “Consider your individual needs and risk tolerance.”

In conclusion, fixed annuities with long-term care riders offer a unique way to address both retirement income and potential long-term care costs. By carefully considering your individual needs and comparing different policies, you can make an informed decision about whether this product is the right fit for securing your future. Contact us at AutoTipPro at +1 (641) 206-8880 or visit our office at 500 N St Mary’s St, San Antonio, TX 78205, United States for personalized guidance.

Leave a Reply