When your car breaks down, the phrase “I Need A Loan To Fix My Car” becomes a common refrain. Finding the right financial solution can be stressful, especially when facing unexpected repair costs. This guide offers valuable insights into securing a loan for car repairs, exploring various options and providing expert advice to help you navigate this challenging situation.

Understanding Your Car Repair Loan Options

There are several avenues to explore when seeking financial assistance for car repairs. Understanding these options is crucial for making an informed decision.

-

Personal Loans: These loans offer a fixed amount with a predetermined repayment schedule, providing predictable monthly payments. They are available from banks, credit unions, and online lenders.

-

Secured Loans: Secured loans use collateral, like your car or another asset, to back the loan. This can result in lower interest rates but carries the risk of losing the collateral if you default.

-

Credit Cards: Using a credit card for car repairs can be convenient, but high interest rates can make this a costly option if not paid off quickly. Look for cards with promotional 0% APR periods if possible.

-

Auto Repair Loans: Some lenders specialize in auto repair loans, often working directly with repair shops to streamline the process. These loans can be a good option if you have less-than-perfect credit.

Exploring Car Repair Loan Options – Personal Loans, Secured Loans, Credit Cards, and Auto Repair Loans

Exploring Car Repair Loan Options – Personal Loans, Secured Loans, Credit Cards, and Auto Repair Loans

After the initial assessment of your situation, exploring available options becomes paramount. It’s important to compare interest rates, loan terms, and fees to find the best fit for your budget. Don’t rush the process. Take your time to understand the terms and conditions before committing to any loan.

How to Choose the Right Loan for Your Car Repair Needs

Choosing the right loan depends on your individual financial situation and the cost of the repairs. Consider factors like your credit score, income, and the urgency of the repairs.

-

Credit Score: A good credit score will qualify you for lower interest rates and better loan terms.

-

Income: Lenders will assess your income to determine your ability to repay the loan.

-

Repair Costs: The total cost of repairs will influence the loan amount you need.

-

Loan Term: A longer loan term means lower monthly payments, but you’ll pay more interest over time.

Factors to Consider When Choosing a Car Repair Loan – Credit Score, Income, Repair Costs, Loan Term

Factors to Consider When Choosing a Car Repair Loan – Credit Score, Income, Repair Costs, Loan Term

If you’re unsure which loan is right for you, consulting with a financial advisor can be invaluable. They can help you understand the different options and make the best decision for your circumstances. Similar to fixed payment reduced apr care credit, understanding APR and payment options is essential.

What to Do Before Applying for a Loan

Before applying for a loan, take these essential steps to improve your chances of approval and secure favorable terms.

-

Check Your Credit Report: Review your credit report for errors and address any inaccuracies.

-

Gather Necessary Documents: Prepare documents like pay stubs, bank statements, and proof of insurance.

-

Compare Loan Offers: Shop around and compare loan offers from different lenders to find the best rates and terms.

This proactive approach not only increases your chances of securing a loan but also empowers you to negotiate better terms. Just like considering can i borrow against my 401k to fix a car, thoroughly assessing your financial situation is key.

Tips for Managing Car Repair Costs

While securing a loan can address immediate repair needs, managing car repair costs in the long run requires a proactive approach.

-

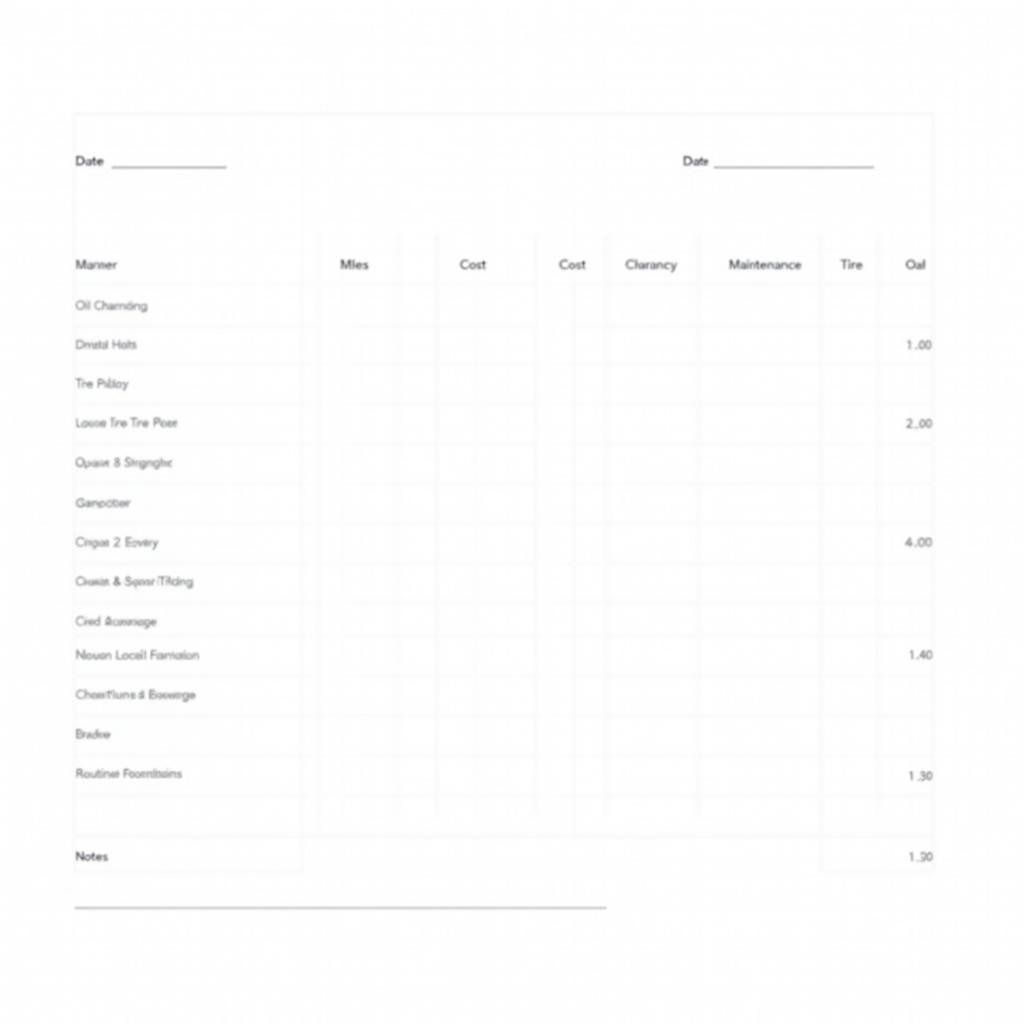

Regular Maintenance: Following a regular maintenance schedule can prevent costly repairs down the road. This includes oil changes, tire rotations, and brake inspections.

-

Emergency Fund: Building an emergency fund specifically for car repairs can help you avoid taking out a loan in the future.

This might also include considering options like places that fix cars with payment plans for future repairs. It’s also crucial to address situations like needing help when you help i cant afford to fix my car its financed. Moreover, understanding where you can perform minor repairs, such as those described in can i fix my car in autozone parking lot, can help minimize costs.

Tips for Managing Car Repair Costs – Regular Maintenance, Emergency Fund

Tips for Managing Car Repair Costs – Regular Maintenance, Emergency Fund

Conclusion

Needing a loan to fix your car can be a stressful experience, but by understanding your options and taking proactive steps, you can navigate the process effectively. Remember to research thoroughly, compare offers, and prioritize responsible financial planning to ensure you make the best decision for your situation. Connect with AutoTipPro at +1 (641) 206-8880 or visit our office at 500 N St Mary’s St, San Antonio, TX 78205, United States for personalized guidance and support. We’re here to help you get back on the road.

Leave a Reply