Dealing with car troubles can be a real headache, especially when unexpected repairs hit your wallet hard. Insurance for car problems, in the form of extended warranties or mechanical breakdown insurance (MBI), can provide a financial safety net. This guide explores various options for covering those pesky car problems, helping you choose the best protection for your peace of mind.

Understanding Your Insurance for Car Problems Options

There are several ways to insure against car problems, and it’s crucial to understand the differences. The most common options are extended warranties and mechanical breakdown insurance. Do you know which one is right for you?

Extended Warranties

Extended warranties are essentially service contracts that prolong the manufacturer’s original warranty. They typically cover specific components and systems, offering repair or replacement if those parts fail.

- Pros: Often bundled with new car purchases, providing a seamless transition from factory coverage.

- Cons: Can be expensive and may have strict limitations regarding covered repairs and authorized repair shops.

Mechanical Breakdown Insurance (MBI)

MBI is a separate insurance policy that covers repairs for unexpected mechanical failures. Unlike warranties, MBI usually offers more flexibility in choosing repair facilities and may cover a wider range of components.

- Pros: More flexibility and potentially lower cost compared to extended warranties.

- Cons: May require a deductible for each repair and might not cover wear-and-tear items.

Mechanical Breakdown Insurance vs. Extended Warranty Comparison Chart

Mechanical Breakdown Insurance vs. Extended Warranty Comparison Chart

Choosing the Right Insurance for Car Problems

Selecting the right insurance depends on several factors, including your car’s age, mileage, driving habits, and budget. Are you driving a brand new car or a used vehicle?

New Cars: Is an Extended Warranty Worth It?

For new cars, an extended warranty can offer peace of mind by extending the manufacturer’s coverage. However, consider the cost and limitations carefully. Many new cars are already covered by comprehensive warranties, making an extended warranty potentially redundant.

Used Cars: The Case for MBI

MBI is often a better fit for used cars, offering valuable protection against unexpected breakdowns without the restrictions of an extended warranty. It’s essential to shop around and compare policies to ensure adequate coverage.

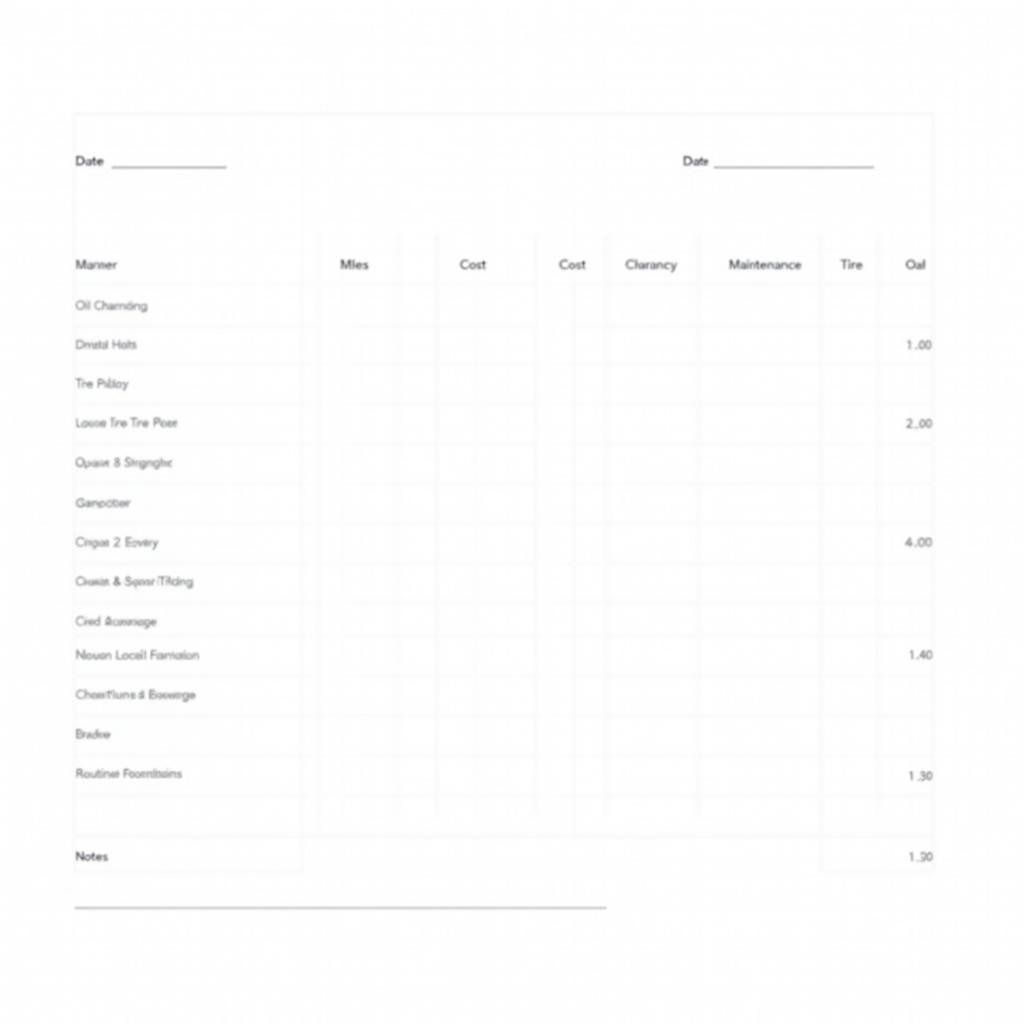

What Does Insurance for Car Problems Typically Cover?

Coverage varies between policies, but some commonly covered components include the engine, transmission, drive axle, steering, brakes, electrical system, air conditioning, and heating. Understanding what is and isn’t covered is crucial before purchasing any insurance for car problems.

Exclusions: What’s Not Covered?

Most insurance for car problems excludes routine maintenance, wear-and-tear items (like tires and brakes), and damage caused by accidents or neglect. Read the policy carefully to understand the specific exclusions.

“A well-informed car owner is a protected car owner. Don’t just assume you’re covered – understand the fine print,” advises John Davis, Senior Automotive Technician at Davis Auto Repair.

How Much Does Insurance for Car Problems Cost?

The cost of insurance for car problems varies depending on factors like the vehicle’s make, model, age, mileage, and the chosen coverage level. It’s always best to get quotes from multiple providers and compare.

Saving Money on Insurance for Car Problems

Negotiating with dealers for extended warranties and comparing quotes from different MBI providers can help you find the best deal.

“Don’t be afraid to negotiate. Dealerships often have room to maneuver on the price of extended warranties,” says Maria Sanchez, Certified Financial Advisor at MoneyWise Consulting.

Conclusion: Protecting Your Investment with Insurance for Car Problems

Car repairs can be expensive and unexpected. Having insurance for car problems, whether through an extended warranty or MBI, can provide a safety net and protect your investment. By understanding your options and choosing the right coverage for your needs, you can drive with greater peace of mind. Need further assistance? Contact AutoTipPro at +1 (641) 206-8880 or visit our office at 500 N St Mary’s St, San Antonio, TX 78205, United States.

“Investing in insurance for car problems is like investing in your peace of mind. Knowing you’re covered for unexpected repairs can significantly reduce stress,” says Michael Johnson, Automotive Engineer at Johnson Automotive Solutions.

Leave a Reply