Car maintenance is essential for keeping your vehicle running smoothly and safely. But can you deduct these costs from your taxes? This is a common question for car owners, and understanding the answer can save you money. Let’s dive into the specifics of car maintenance and tax deductions.

Understanding Car Maintenance Tax Deductibility

Unfortunately, for the average driver, regular car maintenance expenses like oil changes, tire rotations, and brake replacements are generally not tax deductible. These costs are considered personal expenses, similar to groceries or clothing. However, there are specific situations where car maintenance can be a tax write-off. These situations usually involve using your vehicle for business purposes.

When Car Maintenance Is Tax Deductible

The deductibility of car maintenance expenses hinges primarily on how you use your vehicle. If you use your car solely for personal commuting, you’re out of luck. However, if you use your vehicle for business purposes, the IRS offers two methods for deducting car expenses: the standard mileage rate and the actual expense method.

The Standard Mileage Rate Method

This method is the simplest. The IRS sets a standard mileage rate each year that covers all operating costs, including maintenance, repairs, gas, insurance, and depreciation. You simply multiply your business miles driven by the standard mileage rate to calculate your deduction. This method eliminates the need to keep detailed records of every expense.

The Actual Expense Method

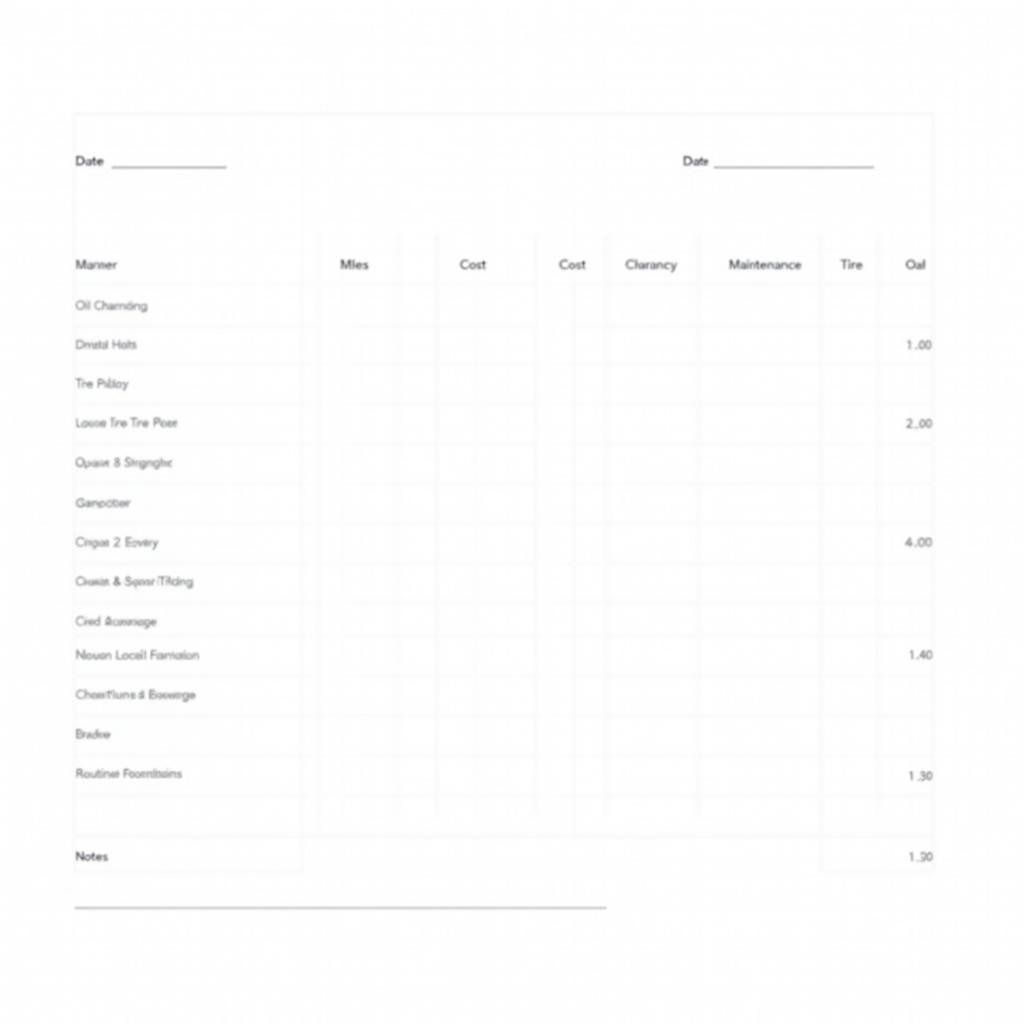

With this method, you track all actual car expenses, including maintenance and repairs. You can then deduct a percentage of these expenses based on the percentage of your driving that’s business-related. This method can be beneficial if your actual expenses are significantly higher than the standard mileage rate allowance, especially for vehicles with high maintenance costs. It requires meticulous record-keeping.

![]() Tracking Car Maintenance Expenses for Tax Deductions

Tracking Car Maintenance Expenses for Tax Deductions

Self-Employed Individuals and Small Business Owners

If you’re self-employed or own a small business and use your vehicle for work, you’re more likely to be eligible for these deductions. This could include real estate agents, delivery drivers, or sales representatives who travel to meet clients. Keeping accurate records of mileage and expenses is crucial for claiming deductions.

Specific Examples of Deductible Car Maintenance

- Repairing a broken delivery van used for your business: This is deductible under the actual expense method.

- Regular maintenance on a car used for business travel: This can be included in the standard mileage rate or deducted under the actual expense method.

Mechanic Working on a Business Vehicle

Mechanic Working on a Business Vehicle

Keeping Accurate Records

Regardless of the deduction method you choose, meticulous record-keeping is crucial. Maintain a logbook detailing your business mileage, including dates, destinations, and the purpose of each trip. Keep all receipts for gas, maintenance, repairs, insurance, and other car expenses. This will make tax time less stressful and provide proof of your expenses should the IRS inquire.

Consult a Tax Professional

Tax laws can be complex, and it’s always best to consult with a qualified tax professional for personalized advice. They can help you determine the best deduction method for your specific situation and ensure you’re claiming all eligible deductions. This is especially important if your car usage falls into a gray area.

Conclusion

While routine car maintenance isn’t typically tax deductible for personal use, it can be when your car is used for business. Understanding the different deduction methods and keeping accurate records are key to maximizing your tax savings. For personalized advice, consult a tax advisor. Connect with us at AutoTipPro for more car maintenance tips and advice. Our phone number is +1 (641) 206-8880 and our office is located at 500 N St Mary’s St, San Antonio, TX 78205, United States.

FAQ

-

Can I deduct car washes for my business vehicle? Yes, car washes for a business vehicle are considered a deductible business expense under the actual expense method.

-

What if I use my car for both personal and business use? You can only deduct the portion of your expenses related to business use.

-

Does the standard mileage rate change every year? Yes, the IRS adjusts the standard mileage rate annually.

-

What records do I need to keep for the actual expense method? You’ll need receipts for all car-related expenses, including maintenance, repairs, gas, and insurance, along with a mileage log.

-

Can I switch between the standard mileage rate and the actual expense method? Yes, you can switch methods, but there are certain rules and restrictions.

-

Is parking deductible for business use? Yes, parking fees directly related to business use are deductible.

-

Where can I find the current standard mileage rate? You can find the current rate on the IRS website.

Leave a Reply