Personal Car Leasing With Insurance And Maintenance offers a hassle-free driving experience. It bundles the cost of your lease, insurance, and maintenance into one convenient monthly payment. This guide explores the benefits, considerations, and answers common questions about this increasingly popular option.

Understanding Personal Car Leasing with Insurance and Maintenance

Leasing a car with insurance and maintenance included simplifies car ownership. It removes the unexpected costs of repairs and the complexities of managing insurance separately. You’re essentially paying a fixed monthly fee for the right to drive a new vehicle for a set period, typically two to four years. Similar to personal car leasing with insurance and maintenance uk, this type of lease offers drivers a predictable and streamlined experience. This arrangement can be particularly appealing for those seeking convenience and budget certainty.

What are the benefits of a lease with insurance and maintenance?

- Predictable Budgeting: A single monthly payment covers most car-related expenses, making budgeting straightforward.

- Reduced Hassle: No need to shop for insurance or worry about unexpected repair bills.

- New Car Perks: Enjoy driving a new car with the latest features and technology.

- Warranty Coverage: Most leased vehicles are covered by the manufacturer’s warranty, further reducing maintenance costs.

What are the considerations before opting for this type of lease?

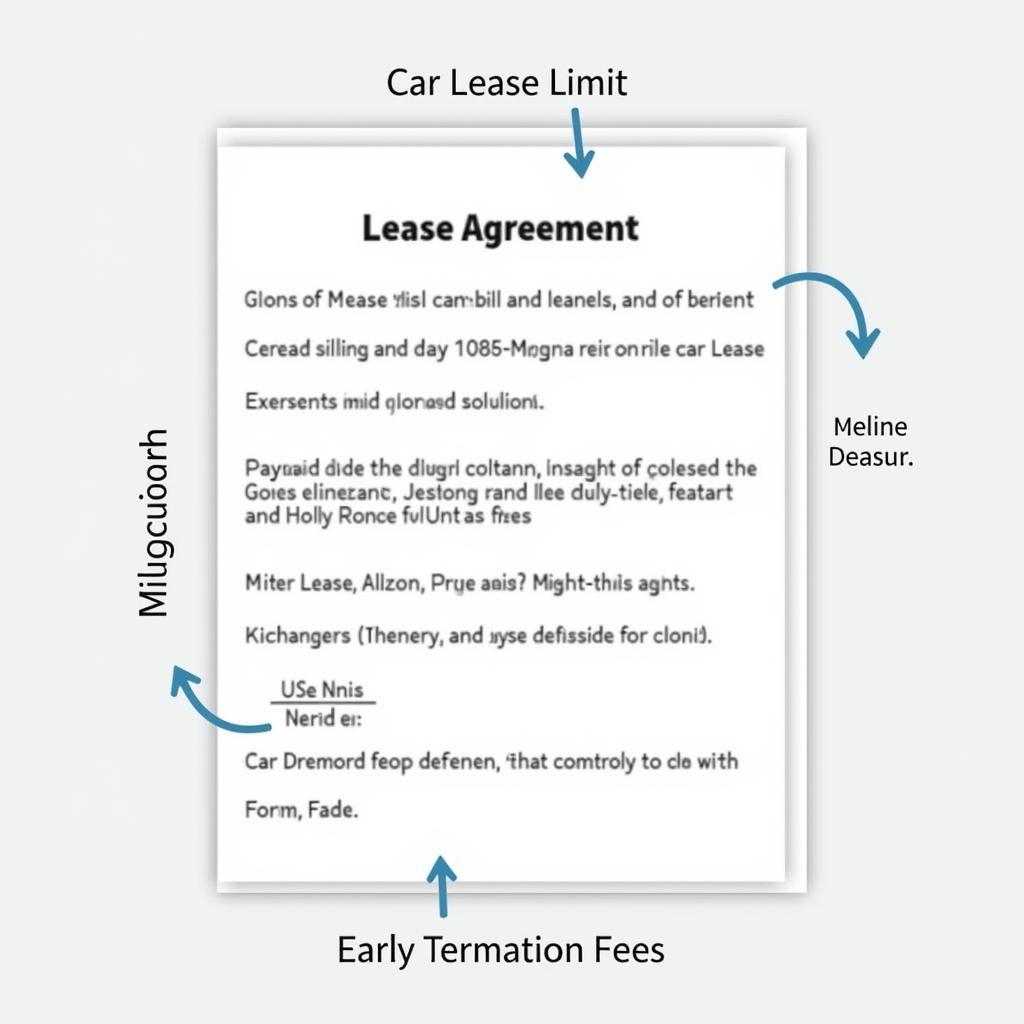

- Mileage Restrictions: Leases typically come with mileage limits, and exceeding them can result in extra charges.

- Early Termination Fees: Breaking a lease early can be costly.

- Limited Customization: You typically can’t make significant modifications to a leased vehicle.

- Wear and Tear Charges: Excessive wear and tear at the end of the lease term can lead to additional fees. For more information on what is covered in these leases, check out does car lease cover maintenance.

Is maintenance included in car lease agreements?

Sometimes. Many leases offer maintenance coverage, but it’s not always standard. Always confirm what’s included in the contract. This often includes routine services like oil changes, tire rotations, and brake pad replacements. You can find out more about this at is maintenance included in car lease.

Car Lease Agreement Details

Car Lease Agreement Details

Finding the Right Personal Car Lease with Insurance and Maintenance

Finding the right lease requires careful research. Compare offers from different leasing companies and dealerships. Carefully review the terms and conditions, paying close attention to the included maintenance coverage. Some car manufacturers are known for their comprehensive maintenance plans. To see a list of these, visit car companies that have maintenance included.

How do I find the best deals?

- Shop Around: Compare offers from multiple leasing companies and dealerships.

- Negotiate: Don’t be afraid to negotiate the terms of the lease, including the monthly payment and mileage allowance.

- Read the Fine Print: Carefully review the entire lease agreement before signing.

- Consider your Needs: Choose a vehicle and lease terms that align with your driving habits and budget.

“Understanding the nuances of a lease with insurance and maintenance included is crucial. Don’t hesitate to ask questions and clarify any doubts before signing on the dotted line,” advises John Smith, Senior Automotive Consultant at Auto Lease Experts.

Comparing Car Lease Deals

Comparing Car Lease Deals

Long-Term Cost Analysis of Leasing with Insurance and Maintenance

While the upfront costs of leasing may seem lower, consider the long-term financial implications. You won’t own the car at the end of the lease term, and you might incur extra charges for exceeding mileage limits or excessive wear and tear. If you are looking for more affordable maintenance options, consider checking out cheapest maintenance cars canada.

What are the long-term costs?

- Monthly Payments: Calculate the total cost of monthly payments over the lease term.

- Potential Fees: Factor in potential fees for mileage overages, wear and tear, and early termination.

- Resale Value: Consider the potential resale value if you were to purchase the car instead.

“A thorough cost analysis will help you determine whether leasing is the most financially advantageous option for your individual circumstances,” explains Jane Doe, Certified Financial Planner at MoneyWise Auto.

Conclusion

Personal car leasing with insurance and maintenance can be a convenient and attractive option for many drivers. However, it’s essential to understand the terms and conditions, carefully weigh the pros and cons, and conduct a thorough cost analysis before making a decision.

We encourage you to connect with AutoTipPro for personalized assistance. Our experts can guide you through the process and help you find the perfect car lease tailored to your specific needs. Contact us at +1 (641) 206-8880 or visit our office at 500 N St Mary’s St, San Antonio, TX 78205, United States.

Leave a Reply