Managing finances for car and truck repair and maintenance can be a real headache. Using QuickBooks categories for car and truck repair and maintenance effectively is crucial for accurate bookkeeping and informed business decisions. This guide provides a comprehensive overview of how to categorize these expenses in QuickBooks, ensuring your financial records are organized and insightful.

Understanding the Importance of Accurate QuickBooks Categories

Accurate categorization in QuickBooks is paramount for several reasons. It allows you to track expenses effectively, generate meaningful reports, and identify areas for potential cost savings. Proper categorization also simplifies tax preparation and ensures compliance with regulations.

Why Choosing the Right Categories Matters

Selecting the correct QuickBooks categories for car and truck repair and maintenance directly impacts your ability to analyze your spending patterns. This data can be invaluable for making informed decisions about fleet management, budgeting, and pricing strategies. Incorrect categorization can lead to skewed financial reports and inaccurate tax filings.

QuickBooks Categories of Car and Truck and Repair and Maintenance: A Deep Dive

There isn’t a one-size-fits-all approach to categorizing these expenses. The best strategy depends on the specifics of your business. Are you a repair shop, a trucking company, or a business with a company vehicle?

Common Categories for Repair and Maintenance Expenses

Here are some common QuickBooks categories you can use:

- Auto: Gas and Fuel: For tracking fuel expenses.

- Auto: Repairs and Maintenance: For general vehicle upkeep.

- Auto: Insurance: For vehicle insurance premiums.

- Truck: Repairs and Maintenance: Specifically for truck repairs.

- Travel: If expenses are related to business travel.

Categorizing for Different Business Types

-

Repair Shops: Use detailed subcategories under “Auto: Repairs and Maintenance” to track expenses by service type (e.g., brakes, engine repair, tires). This granular approach allows you to analyze profitability by service.

-

Trucking Companies: Utilize categories like “Truck: Repairs and Maintenance,” “Truck: Fuel,” and “Truck: Insurance” to track costs associated with individual trucks or the entire fleet.

-

Businesses with Company Vehicles: Use “Auto: Gas and Fuel,” “Auto: Repairs and Maintenance,” and “Auto: Insurance” for company car expenses. Consider subcategories for each vehicle if you have multiple company cars.

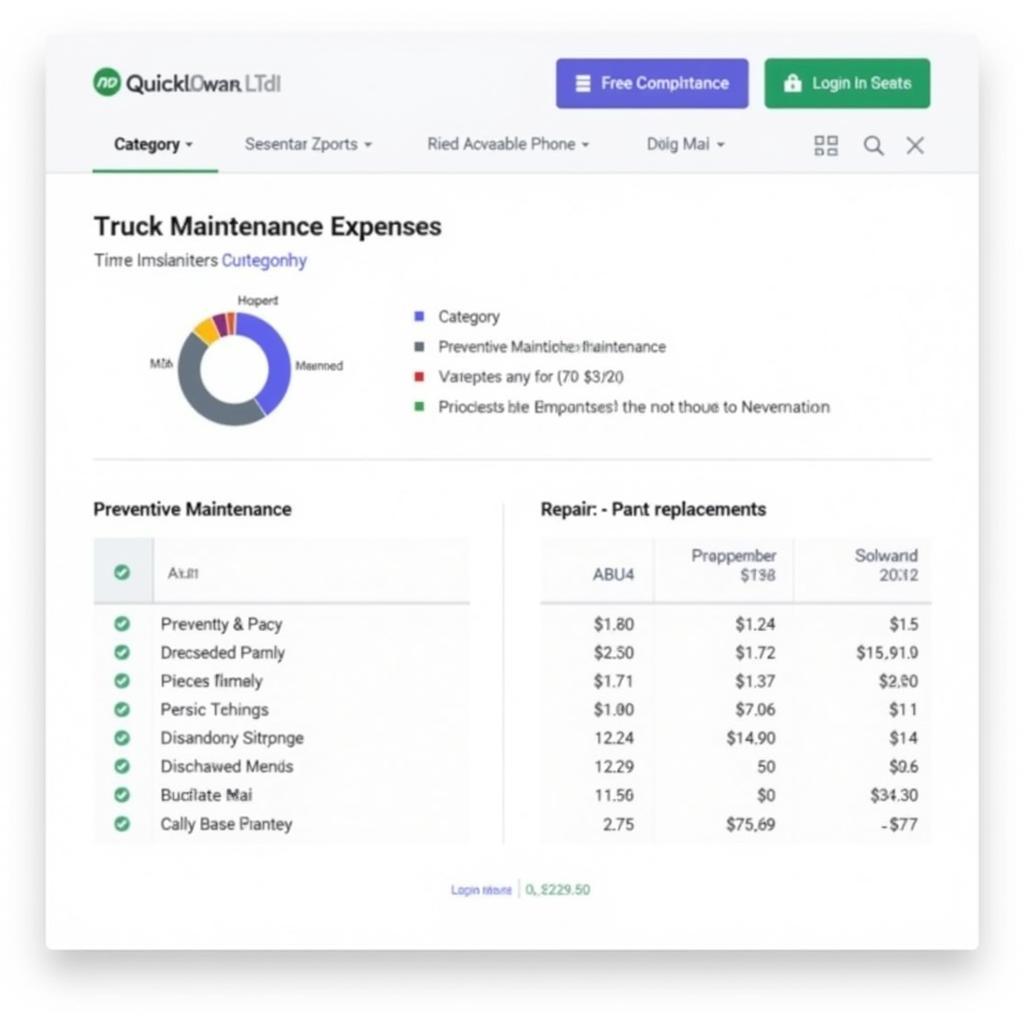

QuickBooks Categories for Truck Maintenance

QuickBooks Categories for Truck Maintenance

Best Practices for Categorizing Car and Truck Repair and Maintenance Expenses

Consistency is key! Establish a clear categorization system and stick to it. This will ensure accurate reporting and make it easier to compare data over time. Regularly review your categories and make adjustments as needed.

Tips for Maintaining Accurate Records

- Itemize Expenses: Don’t lump everything into a single category. Itemize each expense for a more granular view of your spending.

- Use Subaccounts: Utilize subaccounts to further categorize expenses within main categories. For example, under “Auto: Repairs and Maintenance,” create subaccounts for “Tires,” “Brakes,” and “Oil Changes.”

- Attach Receipts: Attach digital copies of receipts to each transaction for easy reference and audit trails.

How Do I Choose the Right QuickBooks Categories?

Choosing the right category depends on the specific expense and your business structure. Consider what the expense is for and which part of your business it benefits.

What if I’m Not Sure Which Category to Use?

If you are unsure, consult with a qualified accountant or bookkeeper. They can help you develop a categorization system that meets your specific needs. Alternatively, QuickBooks support can offer guidance.

Conclusion

Mastering QuickBooks categories for car and truck repair and maintenance is essential for any business that relies on vehicles. By following the best practices outlined in this guide, you can ensure accurate bookkeeping, gain valuable insights into your spending, and make informed decisions that benefit your bottom line. For personalized assistance with your QuickBooks setup, contact AutoTipPro at +1 (641) 206-8880 or visit our office at 500 N St Mary’s St, San Antonio, TX 78205, United States.

FAQs

-

What is the difference between using “Auto” and “Truck” categories in QuickBooks? The “Truck” categories are typically used for businesses that operate heavy-duty trucks, while “Auto” is generally for cars and lighter vehicles.

-

Can I create custom categories in QuickBooks? Yes, you can create custom categories and subcategories to suit your specific business needs.

-

How do I track mileage in QuickBooks? You can use the mileage tracking feature within QuickBooks or integrate with third-party mileage tracking apps.

-

What reports can I generate using these categories? You can generate profit and loss reports, expense reports, and custom reports to analyze your car and truck repair and maintenance expenses.

-

How can accurate categorization help with taxes? Accurate categorization makes it easier to identify deductible expenses and ensures accurate tax filings.

-

Is it necessary to categorize every single expense? Yes, categorizing every expense is crucial for maintaining accurate financial records and generating meaningful reports.

-

What happens if I categorize an expense incorrectly? Incorrect categorization can lead to inaccurate financial reporting and potential tax issues. You can always recategorize transactions if you make a mistake.

Leave a Reply