Maintaining your car can feel like a constant drain on your wallet. Unexpected repairs, routine maintenance, and those pesky warning lights can all add up quickly. That’s where a sinking fund for car maintenance comes into play. A car maintenance sinking fund is a dedicated savings account specifically for car-related expenses, allowing you to budget proactively for inevitable maintenance and repairs. But how much should you actually be saving? Let’s dive in.

Understanding Your Car Maintenance Needs

Before figuring out how much to contribute to your sinking fund car maintenance, you need to understand what your car typically needs. This can vary significantly depending on several factors.

Factors Influencing Car Maintenance Costs

- Vehicle Age: Older cars generally require more frequent and costly repairs than newer ones. Parts wear out, systems become less efficient, and unexpected issues are more likely to arise.

- Make and Model: Some car brands are known for their reliability, while others have a reputation for needing more attention. Research your car’s make and model to get a better idea of common problems and their associated costs.

- Driving Habits: If you’re a heavy commuter or frequently drive in harsh conditions (extreme temperatures, rough terrain), your car will likely need more frequent maintenance.

- DIY vs. Professional Service: Handling minor maintenance tasks yourself can save money, but more complex repairs often require a professional mechanic.

Car Maintenance Cost Factors

Car Maintenance Cost Factors

Calculating Your Sinking Fund Contribution

Now for the million-dollar question: how much should you put aside for sinking fund car maintenance? There’s no one-size-fits-all answer, but here are a few approaches:

The Mileage Method

Estimate an average cost per mile for maintenance. This could be based on your car’s history, similar models, or industry averages. Then, multiply this cost by your estimated annual mileage to get a yearly sinking fund target. Divide that by 12 to get your monthly contribution.

The Age-Based Method

As cars age, maintenance costs tend to increase. You could start with a lower contribution for a newer car and gradually increase it as the vehicle gets older. Research typical maintenance schedules for your car’s make and model to anticipate future expenses.

The Hybrid Approach

Combine both the mileage and age-based methods for a more comprehensive approach. This accounts for both the usage and the wear and tear of your vehicle over time.

Tips for Managing Your Car Maintenance Sinking Fund

- Set up automatic transfers: Schedule regular transfers to your sinking fund, even if it’s a small amount. Consistency is key.

- Track your expenses: Keep receipts and records of all car maintenance and repairs. This helps you refine your sinking fund contributions over time and identify any potential issues with your vehicle.

- Review and adjust: Periodically review your sinking fund balance and adjust your contributions as needed. Life throws curveballs, so be prepared to modify your strategy if necessary.

“Regular maintenance is like investing in your car’s future,” says Robert Johnson, Senior Automotive Technician at Johnson’s Auto Repair. “A well-maintained car is safer, more reliable, and ultimately saves you money in the long run.”

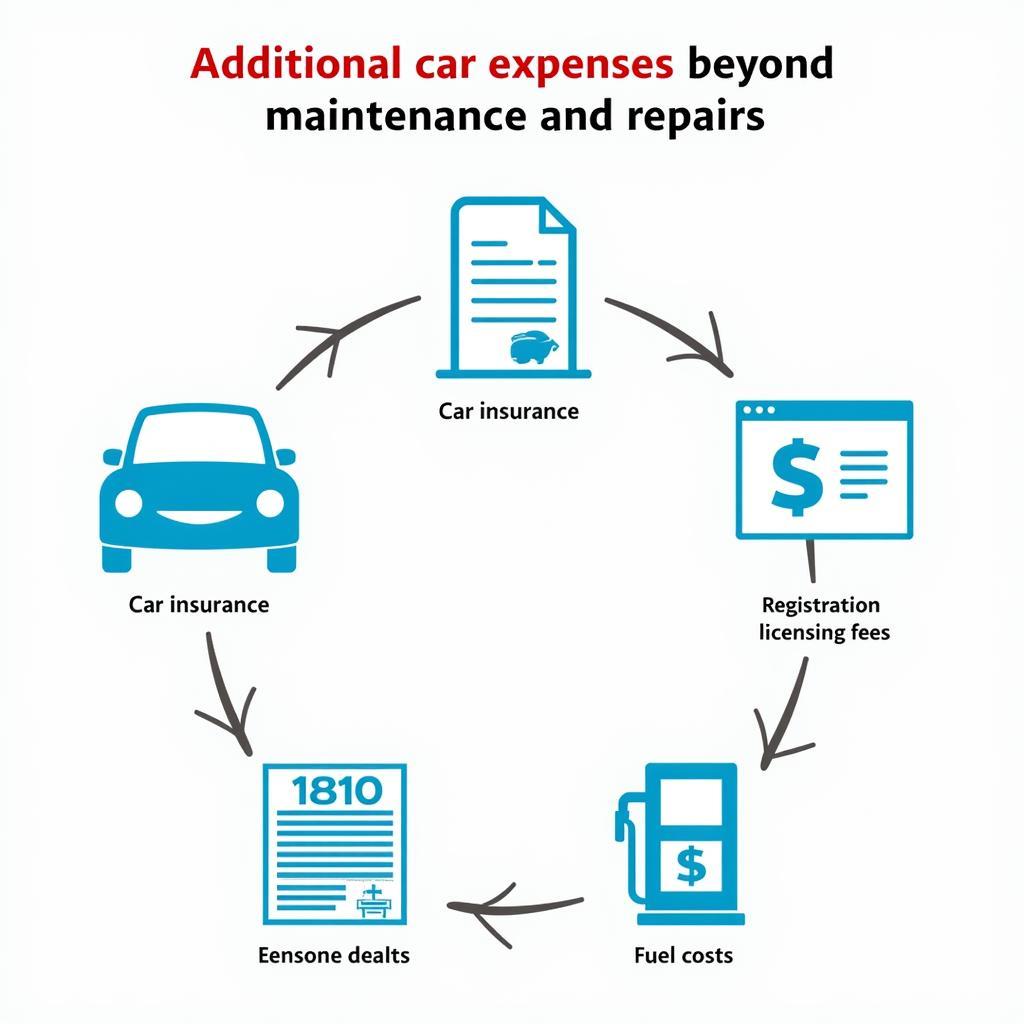

Don’t Forget These Additional Car Expenses

While your sinking fund primarily covers maintenance and repairs, remember to factor in other car-related expenses:

- Insurance: Car insurance is a mandatory expense in most places.

- Registration and Licensing: These are typically annual fees.

- Fuel: Gas or electricity costs should be part of your overall car budget.

Additional Car Expenses

Additional Car Expenses

Conclusion: Sinking Fund Car Maintenance – Peace of Mind on the Road

Establishing a sinking fund car maintenance is a smart financial move. By setting aside funds regularly, you can avoid the stress of unexpected car repairs and keep your vehicle running smoothly. While determining the exact amount for your sinking fund requires some research and planning, the peace of mind it provides is invaluable. Contact us at AutoTipPro at +1 (641) 206-8880 or visit our office at 500 N St Mary’s St, San Antonio, TX 78205, United States for personalized guidance on your car maintenance needs.

“A sinking fund not only prepares you financially for car repairs but also empowers you to make informed decisions about your vehicle,” adds Sarah Chen, Certified Financial Advisor at Secure Finances. “You won’t have to compromise on quality or safety when unexpected issues arise.”

FAQ

- What if I don’t use all the money in my sinking fund? You can roll it over to the next year or use it towards a down payment on a new car.

- Is a sinking fund different from an emergency fund? Yes, a sinking fund is for planned expenses, while an emergency fund is for unexpected financial hardships.

- Can I use a credit card for car repairs and then reimburse myself from the sinking fund? While possible, it’s best to avoid accumulating debt if you can pay directly from the sinking fund.

- What if my car requires a major repair beyond my sinking fund balance? You might need to supplement with your emergency fund or explore financing options.

- How often should I review my sinking fund contribution? At least annually, or whenever your driving habits or car’s age significantly change.

- Are tires considered part of maintenance? Yes, tires are a routine maintenance item and should be factored into your sinking fund.

- Can I include car modifications in my sinking fund? It’s best to create a separate fund for modifications as they are not essential maintenance expenses.

Leave a Reply